World

Revealed: Credit Suisse leak unmasks criminals, fraudsters and corrupt politicians

A massive leak from one of the world’s biggest private banks, Credit Suisse, has exposed the hidden wealth of clients involved in torture, drug trafficking, money laundering, corruption and other serious crimes.

Details of accounts linked to 30,000 Credit Suisse clients all over the world are contained in the leak, which unmasks the beneficiaries of more than 100bn Swiss francs (£80bn)* held in one of Switzerland’s best-known financial institutions.

The leak points to widespread failures of due diligence by Credit Suisse, despite repeated pledges over decades to weed out dubious clients and illicit funds. The Guardian is part of a consortium of media outlets given exclusive access to the data.

We can reveal how Credit Suisse repeatedly either opened or maintained bank accounts for a panoramic array of high-risk clients across the world.

They include a human trafficker in the Philippines, a Hong Kong stock exchange boss jailed for bribery, a billionaire who ordered the murder of his Lebanese pop star girlfriend and executives who looted Venezuela’s state oil company, as well as corrupt politicians from Egypt to Ukraine.

One Vatican-owned account in the data was used to spend €350m (£290m) in an allegedly fraudulent investment in London property that is at the centre of an ongoing criminal trial of several defendants, including a cardinal.

The huge trove of banking data was leaked by an anonymous whistleblower to the German newspaper Süddeutsche Zeitung. “I believe that Swiss banking secrecy laws are immoral,” the whistleblower source said in a statement. “The pretext of protecting financial privacy is merely a fig leaf covering the shameful role of Swiss banks as collaborators of tax evaders.”

Credit Suisse said that Switzerland’s strict banking secrecy laws prevented it from commenting on claims relating to individual clients.

“Credit Suisse strongly rejects the allegations and inferences about the bank’s purported business practices,” the bank said in a statement, arguing that the matters uncovered by reporters are based on “selective information taken out of context, resulting in tendentious interpretations of the bank’s business conduct.”

The bank also said the allegations were largely historical, in some instances dating back to a time when “laws, practices and expectations of financial institutions were very different from where they are now”.

While some accounts in the data were open as far back as the 1940s, more than two-thirds were opened since 2000. Many of those were still open well into the last decade, and a portion remain open today.

The timing of the leak could hardly be worse for Credit Suisse, which has recently been beset by major scandals. Last month, it lost its chairman, António Horta-Osório, after he twice broke Covid-19 regulations.

That capped an unprecedented year of controversies in which the bank became embroiled in the collapse of the supply chain finance firm Greensill Capital and the US hedge fund Archegos Capital, and was fined £350m over its role in a loan scandal in Mozambique.

This month, Credit Suisse became the first major Swiss bank in the country’s history to face criminal charges – which it denies – relating to allegation it helped launder money from the cocaine trade on behalf of the Bulgarian mafia.

However, the repercussions of the leak could be much broader than one bank, threatening a crisis for Switzerland, which retains one of the world’s most secretive banking laws. Swiss financial institutions manage about 7.9tn CHF (£6.3tn) in assets, nearly half of which belongs to foreign clients.

The Suisse secrets project sheds a rare light on one of the world’s largest financial centres, which has grown used to operating in the shadows. It identifies the convicts and money launderers who were able to open bank accounts, or keep them open for years after their crimes emerged. And it reveals how Switzerland’s famed banking secrecy laws helped facilitate the looting of countries in the developing world.

Disgraced executives, fraudsters, traffickers – clients

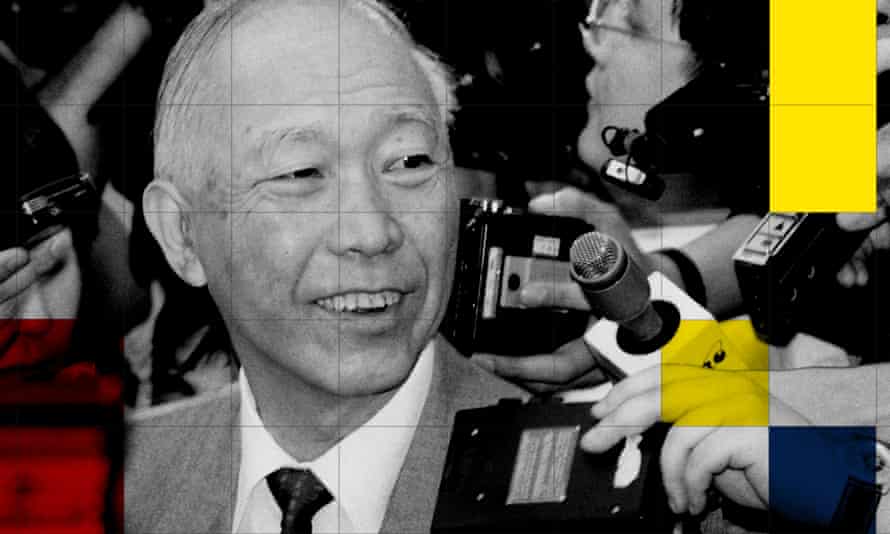

When Ronald Li Fook-shiu approached a banker to open an account in 2000, he is unlikely to have been viewed as a run-of-the-mill client. A former chairman of the Hong Kong stock exchange, he was one of the wealthiest people in the city, where he was known as the “godfather of the stock market”. But he was perhaps better known for the time he spent in a maximum security prison.

Li’s career had ended in disgrace in 1990, when he was convicted of taking bribes in exchange for listing companies on the stock exchange. However, a decade later Li was nonetheless able to open an account that later held 59m CHF (£26.3m), according to the leak.

He has since died, but his case is one of dozens discovered by reporters appearing to show Credit Suisse opened or maintained accounts for clients who had serious convictions that might be expected to show up in due diligence checks. There are other instances in which Credit Suisse may have taken quick action after red flags emerged, but the case nonetheless shows that dubious clients have been attracted to the bank.

Like every other bank in the world, Credit Suisse professes to have stringent control mechanisms to carry out extensive due diligence on its customers to “ensure that the highest standards of conduct are upheld”. In banking parlance, such controls are called know-your-client or KYC checks.

A 2017 leaked report commissioned by Switzerland’s financial regulator shed some light on the bank’s internal procedures at that time. Clients would face intensified scrutiny when flagged as a politically exposed person from a high-risk country, or a person involved in a high-risk activity such as gambling, weapons trading, financial services or mining, the report said.

Relationship managers were expected to use external sources to verify customers and their risk levels, according to the leak, including news articles or databases such as the Thomson Reuters World-Check platform, which is used widely in the financial services sector to flag when people are arrested, charged, investigated or convicted of a serious crime.

Such controls might be expected to prevent a bank from opening accounts for clients such as Rodoljub Radulović, a Serbian securities fraudster indicted in 2001 by the US Securities and Exchange Commission. However, the leaked data identifies him as the co-signatory of two Credit Suisse company accounts. The first was opened in 2005, the year after the SEC had secured a default judgment against Radulović for running a pump-and-dump scheme.

One of Radulović’s company accounts held 3.4m CHF (£2.2m) before they closed in 2010. He was recently given a 10-year prison sentence by a court in Belgrade for his role trafficking cocaine from South America for the organised crime boss Darko Šarić. Radulović’s lawyer did not respond to multiple requests for comment.

Due diligence is not only for new clients. Banks are required to continually reassess existing customers. The 2017 report said Credit Suisse screened customers at least every three years and as often as once a year for the riskiest clients. Lawyers for Credit Suisse told the Guardian these periodic reviews were introduced “more than 15 years ago”, meaning it was continually running due diligence on existing clients from 2007.

The bank might, therefore, have been expected to have discovered that its German client Eduard Seidel was convicted of bribery in 2008. Seidel was an employee of Siemens. As the multinational’s lead in Nigeria, he oversaw a campaign of industrial-scale bribery to secure lucrative contracts for his employer by funnelling cash to corrupt Nigerian politicians.

After German authorities raided the Munich headquarters of Siemens in 2006, Seidel immediately confessed his role in the bribery scheme, though he said he had never stolen from the company or appropriated its slush funds. His involvement in the corruption led to his name being entered into the Thomson Reuters World-Check database in 2007.

However, the leaked Credit Suisse data shows his accounts were left open until at least well into the last decade. At one point after he left Siemens, one account was worth 54m CHF (£24m). Seidel’s lawyer declined to say whether the accounts were his. He said his client had addressed all outstanding matters relating to his bribery offences and wished to move on with his life.

The lawyer did not respond to repeated invitations to explain the source of the 54m CHF. Siemens said it did not know about the money and that its review of its own cashflows shed no light on the account.

While Credit Suisse said in its statement it could not comment on any specific clients, the bank said “actions have been taken in line with applicable policies and regulatory requirements at the relevant times, and that related issues have already been addressed”.

In some instances, Credit Suisse is understood to have frozen accounts belonging to problematic clients. Yet questions remain about how quickly the bank moved to close them.

One client, Stefan Sederholm, a Swedish computer technician who opened an account with Credit Suisse in 2008, was able to keep it open for two-and-a-half years after his widely reported conviction for human trafficking in the Philippines, for which he was given a life sentence.

Sederholm’s crime first came to light in 2009, when police in Manila raided a storefront purporting to be the local chapter of the Mindanao Peoples’ Peace Movement, and discovered about 17 women in cubicles with webcams performing sex shows for foreign customers. He was convicted in 2011.

A representative for Sederholm said Credit Suisse never froze his accounts and did not close them until 2013 when he was unable to provide due diligence material. Asked why Sederholm needed a Swiss account, they said that he was living in Thailand when it was opened, adding: “Can you please tell me if you would prefer to put your money in a Thai or Swiss bank?”

Ferdinand and Imelda pillage the Philippines

Swiss banks have cultivated their trusted reputation since as far back as 1713, when the Great Council of Geneva prohibited bankers from revealing details about the fortunes being deposited by European aristocrats. Switzerland soon became a tax haven for many of the world’s elites and its bankers nurtured a “duty of absolute silence” about their clients affairs.

The custom was enshrined in statute in 1934 with the introduction of Switzerland’s banking secrecy law, which criminalised the disclosure of client banking information to foreign authorities. Within decades, wealthy clients from all over the world were flocking to Swiss banks. Sometimes, that meant clients with something to hide.

One of the most notorious cases in Credit Suisse’s history involved the corrupt Philippine dictator Ferdinand Marcos and his wife, Imelda. The couple are estimated to have siphoned as much as $10bn from the Philippines during the three terms Ferdinand was president, which ended in 1986.

It has long been known that Credit Suisse was one of the first banks to help the Marcoses ravage their own country and in one infamous episode even helped them open Swiss accounts under the fake names “William Saunders” and “Jane Ryan”. In 1995, a Zurich court ordered Credit Suisse and another bank to return $500m of stolen funds to the Philippines.

The leaked data contains an account that belonged to Helen Rivilla, an attorney convicted in 1992 for helping launder money on behalf of Ferdinand Marcos. Despite this, she was able to open a Swiss account in 2000, as was her husband, Antonio, who faced similar charges that were subsequently dropped.

Credit:The Guardian

Top Stories16 hours ago

Top Stories16 hours agoTinubu’s Aide Condemns Plan To Reinstall ‘Jesus Is Not God’ Banner In Lekki Mosque

Top Stories11 hours ago

Top Stories11 hours agoBreaking: FIRS Announces Fresh Recruitment, See Eligibility Criteria, Application Deadline

News16 hours ago

News16 hours agoPetrol To Sell ₦935/Litre From Today – IPMAN

Top Stories16 hours ago

Top Stories16 hours ago2025 Budget Cannot Address Nigeria’s Economic Challenges – Atiku

Top Stories13 hours ago

Top Stories13 hours agoPrimate Ayodele’s Prophecies For 2025

Entertainment16 hours ago

Entertainment16 hours agoI will be more influential in Nigeria than UK – Tobi Adegboyega

News16 hours ago

News16 hours agoPresident Tinubu’s reforms not responsible for food stampedes – FG