Top Stories

Breaking: CBN raises monetary policy rate to 15.5%, highest in 20 years

CBN has raised monetary policy rate to 15.5%, highest in 20 years.

The Monetary Policy Committee of the Central Bank of Nigeria has voted to increase the benchmark interest rate (monetary policy rate) to 15.5% from 14%, being the third hawkish move by the apex bank in 2022 following the rising rate of inflation.

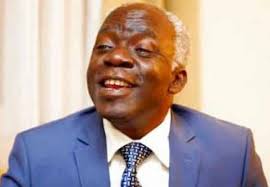

This was disclosed by the Governor of the CBN, Godwin Emefiele, while reading the communique of the monetary policy committee meeting on Tuesday 27th September 2022.

The Central Bank during its last MPC meeting had increased the interest rate from 11.5% to 14% in the last two meetings, however with the inflation rate still spiking above 20%, the CBN has raised the rate further to 15.5% in a bid to combat the rising cost of goods and services.

The last time the apex bank maintained an interest rate higher than 15% was in 2002, bringing the current rate of 15.5% to a 20-year high.

Highlights of the committee’s decision

- MPR raised by 150 basis points from 14% to 15.5%.

- The asymmetric corridor of +100/-700 basis points around the MPR was retained.

- CRR was raised to a minimum of 32.5%.

- The liquidity Ratio was also kept at 30%

Highlights of the committee’s decision

- MPR raised by 150 basis points from 14% to 15.5%.

- The asymmetric corridor of +100/-700 basis points around the MPR was retained.

- CRR was raised to a minimum of 32.5%.

- The liquidity Ratio was also kept at 30%

Committee’s consideration

The focus of the committee was targeted at the aggressive rise in headline inflation, which is already affecting the growth of the economy. The CBN Godwin Emefiele noted that the committee did not consider the option of reducing or holding rates, but rather how much an increase should be made.

- According to the Governor, members deliberated on the impact of the widening margin between the current policy rate of 14% and the inflation rate of 20.52%, leaving the members with the only option of raising interest rates, noting that a loosening stand will be detrimental in reining on inflation.

- Hence, the committee agreed unanimously to raise the policy rate, narrow the negative real interest rate and rein in inflation. Notably, 10 members voted to raise the MPR by 150 basis points, 1 by 100 basis points, and 1 by 50 basis points.

- In the same vein, 10 members voted to increase the CRR by 500 basis points, while two members voted to increase it by 750 basis points.

With the benchmark interest rate now at a record high of 15.5%, the cost of credit is expected to rise, as well as the yield of government fixed securities, while the CBN will continue to use the CRR to mop up liquidity in the financial sector.

Entertainment23 hours ago

Entertainment23 hours agoPrince Harry renounces British residency as he declares US his ‘new country’

Top Stories23 hours ago

Top Stories23 hours agoWe will no longer allow obstruction of our operations after Ododo interfered in Yahaya Bello’s attempted arrest – EFCC

Top Stories17 hours ago

Top Stories17 hours agoBreaking: Police Apologizes Over Reports Of DJ Switch’s Arrest

Politics23 hours ago

Politics23 hours agoFIRS Chairman Releases Statement As Tinubu Inaugurates National Single Window Committee

News16 hours ago

News16 hours agoHeritage Bank In Crisis…Shut Down Over Mass Sack, Undue Process

News22 hours ago

News22 hours agoIyalode Line Visits Olubadan Designate

Top Stories23 hours ago

Top Stories23 hours agoEFCC: Why Yahaya Bello Can’t Evade Arrest, Prosecution — Falana

News20 hours ago

News20 hours agoBlack Market Dollar (USD) To Naira (NGN) Exchange Rate Today 18th April 2024