Top Stories

BREAKING: Exchange Rate Crashes To #800 Per Dollar In Parallel Market

Exchange Rate has crashed to #800 per dollar in the parallel market.

CityNews Nigeria reports that the naira downward streak has reached another historical low under President Muhammadu Buhari’s government, currently trading at 800 against the dollar on the parallel exchange platform Aboki Forex.

Checks by our reporter in Ogba and Ikeja axis of Lagos on Saturday showed that the current parallel market rate is N800 to a dollar and N890 to the British pound sterling.

CityNews Nigeria had earlier reported that the naira which had been consistently dropping in value exchanged at 785 against the dollar on Friday, 28th October, 2022.

Naira’s free fall continues as the ban on Bureau the Change operators remain in place and the Central Bank of Nigeria, CBN this week announced plans to redesign the country’s currency in response to the country’s economic woes.

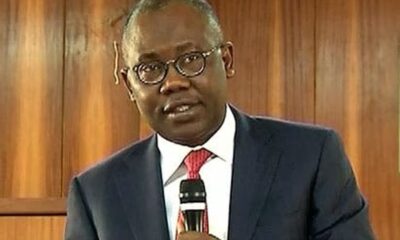

The governor of the central bank, Godwin Emefiele, announced on Wednesday that new naira notes would be issued by December 15.

Mr Emefiele stated that the move, which has since been approved Mr Buhari and other stakeholders, was certain to boost the value of the naira.

Following the latest announcement, politicians have continued to approach BDC operators to easily convert their soon-to-expire stockpiled naira to foreign currencies, as the apex bank gave all Nigerians six weeks to return all old naira notes to the bank’s vault.

To curb inflation, the CBN uses monetary policies to regulate total money in circulation. By reducing the quantity of money in circulation, it helps to curb demand-push inflation, which is derived from the “more money chasing fewer goods” principle.

If truly over 85% of cash in circulation are outside the vault of the commercial banks, then the monetary policy of the bank may not be able to have the desired effect on inflation which stands above 23% as of September 2022.

Aside from inflation, the other issue the CBN is trying to checkmate is the money in the hands of bandits sourced from ransom.

According to Emefiele “the bank is convinced that “the incidents of terrorism and kidnapping would be minimized as access to a large volume of money outside the banking system used as source of funds for ransom payment will begin to dry up.”

Section 20(3) gives the CBN the power to recall notes, subject to the approval of the president.

“Notwithstanding Sub-sections (1) and (2) of this section, the Bank shall have power, if directed to do so by the President and after giving reasonable notice in that behalf, to call in any of its notes or coins on payment of the face value thereof and any note or coin with respect to which a notice has been given under this Sub- section, shall, on the expiration of the notice, cease to be legal tender, but, subject to section 22 of this Act, shall be redeemed by the Bank upon demand.

Despite this power, the announcement by the CBN has generated mixed reactions. Many have taken to social media to reject the proposal by the CBN, stating that it will not address the inflationary pressure facing the country.

Some have also expressed fear that business outlets may start to reject the old Naira notes in anticipation of the deadline set by the bank.

CityNews Nigeria recalls that in 2021, the CBN prohibited the sale of foreign exchange to BDC operators in a bid to arrest the fast fall of the country’s currency. The apex bank had accused the BDCs of unauthorized sales of foreign exchange above the market they were authorized to serve.

BDC operators were a significant part of the black market before the ban, helping people who couldn’t legally access foreign currencies directly from the CBN to maintain their exchange rates.

Top Stories19 hours ago

Top Stories19 hours agoTinubu Deliberately Put Northerners In Key Places – Ribadu

Entertainment7 hours ago

Entertainment7 hours agoGuinness World Record: Davido, Sowore Turn Up To Support Chess Master, Onakoya

News17 hours ago

News17 hours agoBlack Market Dollar (USD) To Naira (NGN) Exchange Rate Today 19th April 2024

Top Stories7 hours ago

Top Stories7 hours agoCourt Discharges, Acquits Ex-AGF Adoke Of Money Laundering

Business and Brands6 hours ago

Business and Brands6 hours agoUBA America Strengthens Commercial Diplomacy, Hosts Diplomats, Business Leaders at World Bank Summit in Washington.

Politics19 hours ago

Politics19 hours agoIsraeli Missiles Hit Iran, Iraq And Syria

Entertainment19 hours ago

Entertainment19 hours agoNollywood Eniola Ajao’s movie ‘Ajakaju’ rakes over N200 million in cinemas

Top Stories18 hours ago

Top Stories18 hours agoResolutions of PDP NEC meeting emerges [FULL TEXT]