Business and Brands

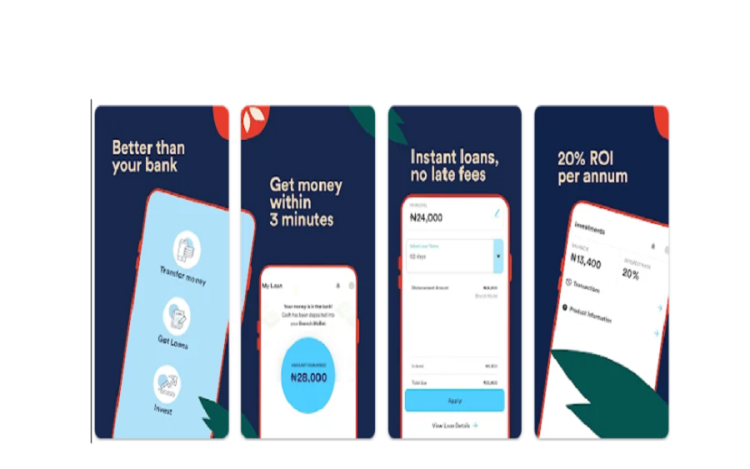

Review: Branch loan app delivers quick, easy loans but with high interest

Loan apps have continued to bridge the financial inclusion gap in Nigeria by providing loan access to millions of Nigerians shut out of the credit system by banks. Although some unlicensed loan apps have become a menace to the system, genuine players continue to deliver on their mandate without compromising the ethics of the business.

Branch, a Kenya-registered business with operations in Nigeria, India, and Tanzania, is one of the licensed loan apps providing instant credits to many Nigerians. Branch has created an algorithmic approach to determine creditworthiness via customers’ smartphones, using machine learning.

According to the company, while this tech-forward approach requires transparency and trust, it also enables a fair, secure, and convenient path for customers to build capital and save for the future.

A quick look at the app

At 8.2MB download size, the Branch app is light and won’t give the users the headache of space on their phones. The user interface looks simple and easy to navigate. And with over 10 million on Google Play Store, the app is one of the favourites for many Nigerians. Suffice it to state that with operations in Kenya, Tanzania, Nigeria, and India, the 10 million downloads is a reflection of the diverse markets.

The company says interest rates on the app range from 15% – 34%. You can get access to loans from N1,000 to N200,000 within 24hrs, depending on your repayment history, with a period of 4 to 40 weeks to pay back. All you need to apply is your phone number or Facebook account, bank verification number (BVN), and bank account number. They will also request access to the data on your phone to build your credit score.

Users’ reviews

As of the last count, over 852, 000 users of the Branch app have reviewed it on the Google Play Store based on their experience. While the app enjoys several positive reviews, some users are concerned that they are unable to get a second loan because they were late in repaying the first. Some also frown at the interest rates on the app, describing them as too high. Here’s what the users are saying:

Godson Chris is one of the satisfied users of the app. According to him, everything about the app is perfect. He said:

- “The process of accessing loans with Branch is quick, easy, and very satisfying. Secondly, no extra charges, and no binding of card upfront. Even when I wanted to make my first repayment, they provided physical bank accounts, and when I used it, my payment reflected on the app a few hours later. I recommend this app for everyone ready to borrow and pay back, to keep the mutual benefits smooth.”

For Fred Ogbeide, the ease of getting loans and paying them back makes the app a great one. He wrote:

- “It is so easy to get a loan, and also very easy to pay back. I definitely will give Branch a 5-star because they deserve it. No issues at all, but the only thing I will still urge you guys to work on is the interest rate. It is quite high, please work on the Interest rate, outside that, it is the best. I recommend Branch to anyone that needs a quick loan, really smooth operation.”

Nweke Franklin also had wonderful remarks for the app, noting that it is the best finance app based on his experience. He said:

- “My experience has been wonderful. It’s the best finance app; very fast, reliable, and safe. It’s not just a loan app, it helps to invest and keeps your investment safe and the interest rate is amazing. The most interesting part of it is their customer care is very friendly and they don’t disturb you with calls and SMS.”

Adekunle Sogbesan also likes the Branch app. However, he noted that the only issue is the interests, which he described as ‘killing’. He said:

- “The app is really good and the support team is fast in resolving problems much of the time. However, the removal and reduction of the benefits when compared to competitors’ offerings have made the app less attractive. Also, the loan interest rates are killing and should be at levels far better than these, but for the failure of Nigerian regulatory agencies.”

For Blessing Osagie, the Branch app is one of the best loan apps in Nigeria despite the high-interest rates. She wrote:

- “This is one of the best apps I have ever seen. It’s Really helpful and I recommend it to anyone that wants a loan; just borrow from them and they won’t disturb you until the due time they’ll just send messages to your phone without calling. I just made a repayment today, but their Interest rate is high please you guys should try and work on it.”

Abayomi Ogunde also rated the app positively but expressed worries about the interest. He wrote:

- “The experience has been so far very good. They don’t harass you with calls or threatening messages. Really awesome service. But in terms of credit rating, am not satisfied with the loan amount after over 6-months and the amount remains ridiculously small while the interest increases faster. This is not fair.”

Branch absolves itself

In response to issues raised by the users, Branch absolved itself of any blame for the users’ credit rating in the interest rates, saying they are automatically decided by the app. The company said:

- “The loan amount is automatically determined by the system based on a number of factors. The interest rate on each loan is determined based on a number of factors, including the cost of lending to us. There are various factors that the system looks at when assessing eligibility.”

Bottomline

There is no doubt that the Branch app is delivering greatly with its instant loans. That the customers are not complaining about any technical glitches or bugs on the app shows that a great deal of expertise went into the app’s design. However, a review of the interest rates on the app may suffice at this time going by the myriad of complaints by users.

Top Stories11 hours ago

Top Stories11 hours agoDele Farotimi Speaks on Lying Against Afe Babalola After Gaining Freedom

News21 hours ago

News21 hours agoBREAKING: OZA CARNIVAL SECURES TOLARAM GROUP, ZENITH BANK PARTNERSHIPS

Politics11 hours ago

Politics11 hours agoPDP Picks Holes In President Tinubu’s Media Chat

Top Stories11 hours ago

Top Stories11 hours agoCourt Orders DSS To Release Miyetti Allah President Pending Trial

News11 hours ago

News11 hours ago100+ Merry Christmas Wishes and Prayers to Send to Family & Friends on Xmas 2024

Entertainment10 hours ago

Entertainment10 hours agoProphet Odumeje issues warning to those discrediting his miracles

Entertainment9 hours ago

Entertainment9 hours agoSeyi Edun wins hearts as she makes peace with Toyin Abraham, shows support for her new movie; Toyin reacts (Video)

Entertainment10 hours ago

Entertainment10 hours agoComedian AY Clarifies Claims Of Shading Funke Akindele, Toyin Abraham,Ladies In Hollywood