Loan apps have continued to bridge the financial inclusion gap in Nigeria by providing loan access to millions of Nigerians shut out of the credit system by banks. Although some unlicensed loan apps have become a menace to the system, genuine players continue to deliver on their mandate without compromising the ethics of the business.

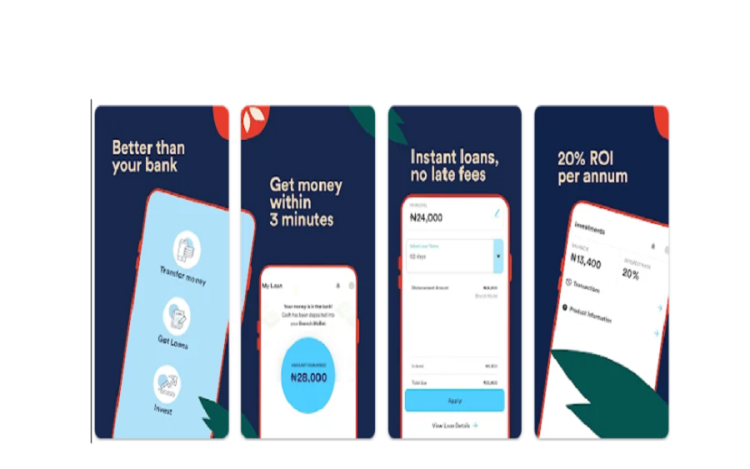

Branch, a Kenya-registered business with operations in Nigeria, India, and Tanzania, is one of the licensed loan apps providing instant credits to many Nigerians. Branch has created an algorithmic approach to determine creditworthiness via customers’ smartphones, using machine learning.

According to the company, while this tech-forward approach requires transparency and trust, it also enables a fair, secure, and convenient path for customers to build capital and save for the future.

At 8.2MB download size, the Branch app is light and won’t give the users the headache of space on their phones. The user interface looks simple and easy to navigate. And with over 10 million on Google Play Store, the app is one of the favourites for many Nigerians. Suffice it to state that with operations in Kenya, Tanzania, Nigeria, and India, the 10 million downloads is a reflection of the diverse markets.

The company says interest rates on the app range from 15% – 34%. You can get access to loans from N1,000 to N200,000 within 24hrs, depending on your repayment history, with a period of 4 to 40 weeks to pay back. All you need to apply is your phone number or Facebook account, bank verification number (BVN), and bank account number. They will also request access to the data on your phone to build your credit score.

As of the last count, over 852, 000 users of the Branch app have reviewed it on the Google Play Store based on their experience. While the app enjoys several positive reviews, some users are concerned that they are unable to get a second loan because they were late in repaying the first. Some also frown at the interest rates on the app, describing them as too high. Here’s what the users are saying:

Godson Chris is one of the satisfied users of the app. According to him, everything about the app is perfect. He said:

For Fred Ogbeide, the ease of getting loans and paying them back makes the app a great one. He wrote:

Nweke Franklin also had wonderful remarks for the app, noting that it is the best finance app based on his experience. He said:

Adekunle Sogbesan also likes the Branch app. However, he noted that the only issue is the interests, which he described as ‘killing’. He said:

For Blessing Osagie, the Branch app is one of the best loan apps in Nigeria despite the high-interest rates. She wrote:

Abayomi Ogunde also rated the app positively but expressed worries about the interest. He wrote:

In response to issues raised by the users, Branch absolved itself of any blame for the users’ credit rating in the interest rates, saying they are automatically decided by the app. The company said:

There is no doubt that the Branch app is delivering greatly with its instant loans. That the customers are not complaining about any technical glitches or bugs on the app shows that a great deal of expertise went into the app’s design. However, a review of the interest rates on the app may suffice at this time going by the myriad of complaints by users.

Human rights advocate Dele Farotimi has been released from the Ekiti State correctional facility after…

A Chief Magistrate in Ibadan, Olabisi Ogunkanmi, has ordered the remand of Prophetess Naomi Silekunola, the…

Popular Nollywood actress, Nkechi Blessing has finally got engaged to her younger lover, Xxssive. This…

Al Nassr captain, Cristiano Ronaldo, has jokingly reacted to a Lionel Messi taunt as he…

Popular Nollywood actress, Regina Daniels who is still enjoying her trip to the United States,…

Jay-Z has no plans to show loyalty to longtime friend Sean 'Diddy' Combs amid the…