Business and Brands

Nigeria’s real inflation rate is actually 52%, far above NBS reports – Steve Hanke

A Professor of Applied Economics at Johns Hopkins University, Professor Steve H. Hanke, has argued that the actual inflation rate in Nigeria is worse than what is being reported by the National Bureau of Statistics.

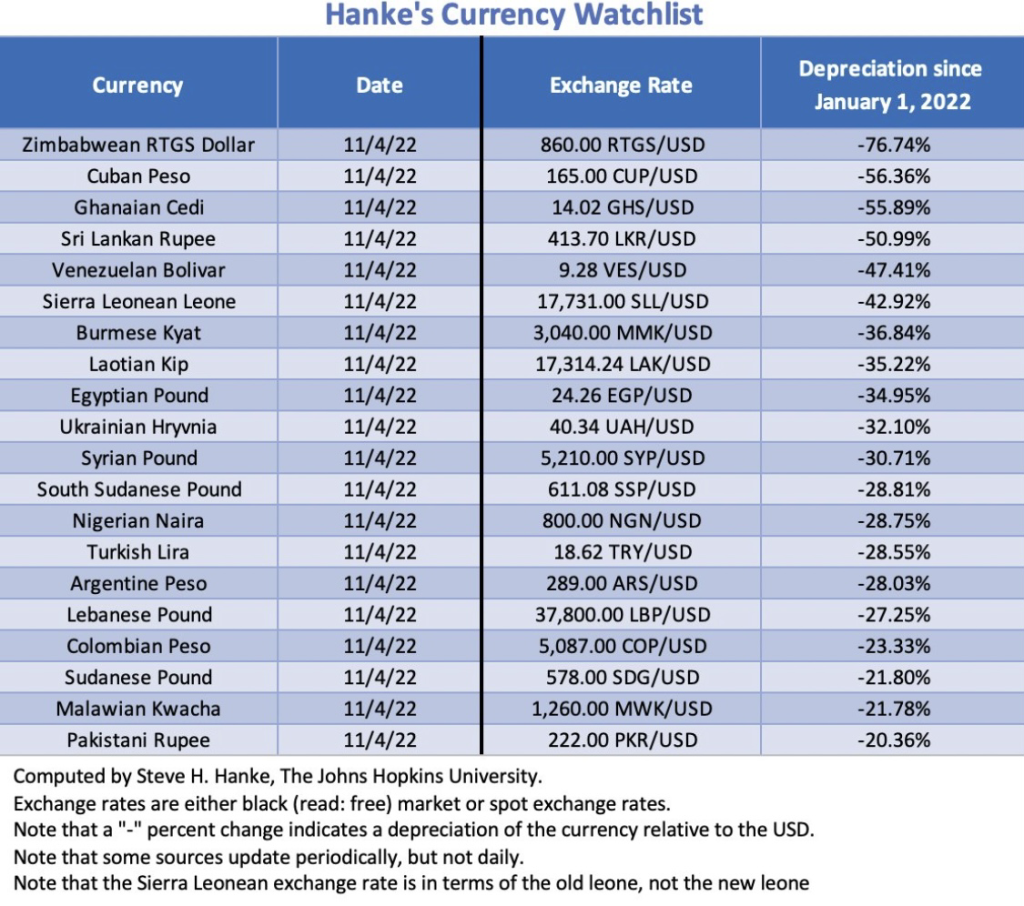

Based on Hanke’s Inflation Dashboard, the inflation rate in Nigeria is an eye-popping 52%, not the 20.8% official record reported for September 2022.

Note that Nigeria ranks 16th out of 23 countries featured in the dashboard.

The methodology used: Professor Steve H. Hanke measured the inflation rate in Nigeria using high-frequency, free-market exchange-rate data in combination with Purchasing Power Parity (PPP) theory. The rapid depreciation of the naira in the black market was also factored into calculating the inflation rate.

The economic theory of PPP is commonly used to compare the economic health of countries. PPP measures are also used by global institutions such as the World Bank, United Nations, International Monetary Fund and European Union.

Disparity with NBS explained: You might wonder why there is a wide gap between Hanke’s inflation rate and the official rate by the NBS. Well, Nairametrics understands that it is because the NBS includes only 740 items in its basket of goods used for creating the Consumer Price Index (CPI). Although this may seem like a lot, it only accounts for a small portion of the goods bought and sold daily in Nigeria.

Hanke’s Inflation Dashboard, on the other hand, incorporates price changes for everything bought and sold in Nigeria, not just those items in the NBS basket.

The NBS calculates the official statistics by measuring the changes in the prices of items in the official basket (in local currency). The NBS also uses a sampling method to determine these prices. The items in the official basket are then given weights and a price index is created.

On the other hand, purchasing power parity is based on exchange rate data and price level differences between two countries. PPP avoids measurement errors and weighting issues common in official price indices.

Limitations of PPP: The theory of purchasing power parity is based on the concept of arbitrage, which is the ability to buy an item in one place and immediately sell it for a higher price in another, taking advantage of price differentials. As a result of the buying and selling, prices would eventually converge. However, transaction costs, government taxation, and trade barriers all prevent costs from equalizing.

News21 hours ago

News21 hours agoBankit Revolutionizes Financial Services with Cutting-Edge Mobile Banking App

Top Stories20 hours ago

Top Stories20 hours agoBREAKING: Tragedy at Ooni’s former wife, ‘Queen Naomi’s event as stampede kills one,many injured’

Entertainment2 hours ago

Entertainment2 hours agoIbadan Tragedy: Ooni’s Ex Wife, Others Face Probe As 32 Kids Feared Dead

News2 hours ago

News2 hours agoOyo Police Detain Principal Over Ibadan Children’s Carnival Stampede

Top Stories2 hours ago

Top Stories2 hours agoBREAKING: Abuja Court Delivers Fresh Judgement On Kogi Ex-Gov, Yahaya Bello

Sports20 hours ago

Sports20 hours agoWhy Lookman won CAF Men’s Player of the Year – Dad

Politics2 hours ago

Politics2 hours agoBREAKING: EFCC Summons Edo LG Chairmen Suspended Over Alleged Misconduct

Top Stories6 hours ago

Top Stories6 hours agoTax Reform: AGF Fagbemi To Meet Senate Today