Tech

What Binance’s CEO Said About Future Of Crypto After FTX’s Rapid Crash

Binance‘s CEO Warns Crypto Crisis Is Not Over after crash of FTX.

Changpeng Zhao is warning investors that FTX’s rapid crash is not the last one for the digital currency market.

Known as CZ because of his vast influence in the crypto sphere, the billionaire is in charge of Binance, the company he co-founded that is the largest cryptocurrency and digital asset exchange in the world in terms of trading volumes.

When his main rival, FTX, was in trouble and faced severe liquidity issues, Zhao stepped in briefly and offered to bail the crypto brokerage out by acquiring it.

But less than a day later after Zhao conducted initial due diligence on FTX, which is run by Sam Bankman-Fried, who was worth $15.6 billion as of Nov. 7, according to Bloomberg Billionaires Index, the deal was canceled.

FTX’s swift demise led to the company filing for Chapter 11 bankruptcy on Nov. 11, and Bankman-Fried, the institutional face of the crypto sphere who owns FTX and trading platform Alameda Research, resigning as CEO.

Zhao warned that the cryptocurrency market, which is worth $1 trillion, is facing a crisis that is not unlike the 2008 financial crisis that brought down investment bank behemoths Lehman Brothers and Bear Stearns.

The collapse of FTX is the first of many and more crypto companies could follow a similar fate, he said.

“With FTX going down, we will see cascading effects,” Zhao said at a conference in Indonesia “Especially for those close to the FTX ecosystem, they will be negatively affected.”

News about the failure of other crypto companies will occur soon, he said.

“A few other projects are going to be in similar situations. I think it will take a couple weeks for most of them to come out,” Zhao said.

Comparing the failure of FTX to the global finance crisis is “probably an accurate analogy” on the company’s downfall.

Neither Binance nor FTX are public so their true valuation is difficult to determine. But the valuation of BNB, the native token of the Binance ecosystem, gives an estimate of the potential valuation of Binance. BNB currently has a market value of $46 billion, according to data firm CoinGecko.

Both BNB and bitcoin have seen valuations plummet by 20% while ethereum dropped even more at 22.5% due to the meltdown of FTX.

Zhao also does not believe FTX can acquire the assets of Voyager, a crypto lender, who is also insolvent. The $1.4 billion deal was struck in September and FTX “obviously . . . won’t have the money.”

Voyager halted the deal on Nov. 11 and said restarted the bidding process and is “in active discussions with alternative bidders.” The bankrupt lender has $3 million currently locked up in FTX, “substantially comprised of locked LUNA2 and locked SRM.”

Genesis, another major crypto trading firm, said its derivatives business had $175 million that are locked on FTX’s exchange, but that the money was “not material to our business” and would not impact its market making or trading functions.

FTX’s liquidity crisis was caused by massive withdrawals from customers on Nov. 6 after Binance announced its decision to sell $500 million worth of FTT, the cryptocurrency issued by FTX following press reports on the group’s financial health.

But Zhao said the industry would recover at some point, stating, “the market will heal itself,” said Zhao.

Entertainment21 hours ago

Entertainment21 hours agoRaining direct c#rses online is a criminal offense — Police PRO

News21 hours ago

News21 hours agoNCC’s Maida To Stakeholders: A2P Messaging, A Powerful Tool For Communication With Citizens

Top Stories19 hours ago

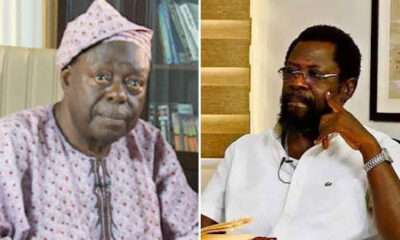

Top Stories19 hours agoPrimate Ayodele releases 2025 prophecies on Tinubu, Atiku, Nnamdi Kanu, Wike, others

Sports16 hours ago

Sports16 hours agoEPL: Man City will turn it around – Guardiola vows

Top Stories20 hours ago

Top Stories20 hours agoDele Farotimi Granted ₦30 Million Bail, Barred From Media Interviews

Top Stories3 hours ago

Top Stories3 hours agoGoods worth millions destroyed as fire guts Ibadan spare parts market [VIDEO]

Top Stories3 hours ago

Top Stories3 hours agoPeter Obi Offers To Meet Dele Farotimi’s Bail Conditions

Sports2 hours ago

Sports2 hours agoNistelrooy Gives Update On Wilfred Ndidi’s Injury Ahead Of Leicester Vs Wolves Clash