Top Stories

Sam Bankman-Fried: FTX Crypto Billionaire Admits His Persona Was a Sham in New Interview

If there were lingering doubts about Sam Bankman-Fried’s strategic thinking—assuming one could overlook the bankruptcy filing, the bizarre tweets, and the billions of dollars in missing customer assets—those doubts surely evaporated after midnight on Wednesday, when the fallen billionaire chose to DM with a reporter at Vox to discuss his imperiled crypto exchange FTX, delivering answers with a level of candor that would make many attorneys retch.

The 30-year-old is experiencing a virtually unprecedented collapse. In rapid succession, he had ascended from MIT wunderkind to millionaire to billionaire to global crypto figurehead, only to have it all vaporize overnight. He doesn’t seem to be taking his downfall well.

Last summer, Bankman-Fried had described his ethical framework to the Vox reporter, Kelsey Piper, telling her that unethical conduct was not acceptable, even in service of “the greater good.”

In their conversation early Wednesday, Piper asked him if he stood by that. “Man, all the dumb shit I said,” he replied. “It’s not true, not really.”

Ethics, he elaborated, aren’t as important to a person’s public standing as whether they achieve success. The worst place to be, he said, is to both be “sketchy” and “lose.”

“I can see why you didn’t give that answer in interviews,” Piper said of the new framing.

Bankman-Fried replied, “heh.”

On Wednesday, the 30-year-old tweeted that he hadn’t intended for his comments to be made public, saying he believed he was speaking to Piper privately as a “friend.” He added that “some of what I said was thoughtless or overly strong.” (Piper disputed that she and Bankman-Fried have been friends and said he did not request for his comments to be kept off the record.)

Investigations into FTX are underway in both the U.S. and Bahamas, where the company is based, though Bankman-Fried—whose parents are both professors at Stanford Law School— has not been charged with any crime. He did not immediately respond to a request for comment.

This week, the former billionaire was also hit by a federal lawsuit seeking class-action status in Miami District Court, which alleged that FTX engaged in a “fraudulent scheme” that caused more than $11 billion in damages to consumers. Celebrities including Tom Brady, Naomi Osaka, Gisele Bundchen and Shark Tank judge Kevin O’Leary were also named as defendants. The lawsuit accused FTX of utilizing the celebrities “to raise funds and drive American consumers to invest…pouring billions of dollars into the [d]eceptive FTX Platform to keep the whole scheme afloat.”

The chaos at FTX has moved quickly. Below are five of the biggest takeaways from this week.

1. Bankman-Fried regrets filing for bankruptcy.

“I fucked up,” he acknowledged to Vox. “Big…multiple times.” But perhaps “my single biggest fuckup,” he declared, was filing for bankruptcy after FTX failed to secure a bailout, leaving it on the brink of collapse. Around the same time, Bankman-Fried was booted as CEO, and the new regime, he asserted, is “trying to burn it all to the ground out of shame.” Had he just waited another month, he grumbled, he might have been able to unfreeze the withdrawal process and make customers whole. Now Bankman-Fried is trying to raise $8 billion to salvage FTX. The obvious question: who would possibly hand over that cash? “There’s a thing about being fallen,” he said. “There are people who know what that’s like, and who want to do for someone else what nobody did for them.”

2. His philanthropic persona was at least partially bogus.

Bankman-Fried spoke endlessly about the philanthropic movement known as effective altruism, which advocates working to “help others” as efficiently and productively as possible. It is similar, but in some ways distinct, from classic utilitarianism. The fallen billionaire admitted to Vox that some of his public statements about ethics were little more than PR baloney. “I feel bad for those who got fucked by it,” he said, referring to “this dumb game we woke westerners play where we say all the right shibboleths so everyone likes us.”

3. Bankman-Fried admits his work with regulators was a farce.

The former FTX leader had cultivated relationships in Washington, testifying before Congress and speaking with regulators and lawmakers. It turns out that was all a sham. His real opinion, per Wednesday’s interview: “Fuck regulators.” According to Bankman-Fried, bureaucrats are inept at differentiating good actors from bad ones—and not just in the world of crypto. The Office of Foreign Assets Control, responsible for enforcing sanctions, he said, “is the single biggest threat” to the U.S. losing its status as a superpower. Even the Food and Drug Administration isn’t useful, he argued. After the Vox article was published, Bankman-Fried walked back some of his comments on Twitter. “It’s *really* hard to be a regulator. They have an impossible job: to regulate entire industries that grow faster than their mandate allows them to,” he wrote. “And so often they end up mostly unable to police as well as they ideally would…Even so, there are regulators who have deeply impressed me with their knowledge and thoughtfulness.”

4. He seems to be playing semantic games about how FTX used customer deposits.

The world took notice when, prior to the epic meltdown, Bankman-Fried deleted a tweet insisting that customer funds were “fine” and that FTX didn’t “invest client assets.” It later emerged that FTX had effectively bailed out Alameda Research, a trading firm Bankman-Fried also cofounded but that operated with a riskier business model. He stood by his comments to Vox, arguing that they were “factually accurate,” since Alameda was under his broader corporate umbrella. But as Axios noted, FTX’s terms of service prohibited using customers’ money to fund trading activity. In Wednesday’s interview, Bankman-Fried said he “didn’t mean to” do “sketchy” stuff, and he partially blamed the mess on shoddy accounting. “Each individual decision seemed fine and I didn’t realize how big their sum was until the end,” he added.

5. FTX had an “in-house performance coach,” and boy is he surprised by the company’s downfall.

In an interview with The New York Times, the psychiatrist George K. Lerner said he coached FTX employees on their careers and mental health. He has trouble buying into the notion of Bankman-Fried as a “criminal mastermind,” he said. Lerner also pushed back against recent intrigue into romantic intermingling between FTX employees, including execs. “They were working way too much,” he said. “The higher-ups, they mostly played chess and board games. There was no partying. They were undersexed, if anything.”

News18 hours ago

News18 hours agoPresidential candidate paid 774 delegates $23m in 2023 election – Dele Momodu Reveals

Politics21 hours ago

Politics21 hours agoDangote Finally Refinery Crashes Petrol Price

Top Stories22 hours ago

Top Stories22 hours agoVAT Attribution and Derivation: A Personal Appeal to all Parties – By M. Nami

Top Stories2 hours ago

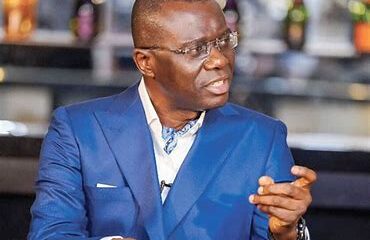

Top Stories2 hours ago#ENDSARS GAFFE: GOVERNOR SANWO-OLU SUSPENDS AIDE

Entertainment22 hours ago

Entertainment22 hours agoOdumeje vows to take punitive action against Nigerians doing this to him in public…..

Entertainment22 hours ago

Entertainment22 hours agoUK court orders David Hundeyin to pay £95,000 for defaming BBC Journalist

News18 hours ago

News18 hours agoBreaking: Gunmen Kill At Least 30 People In Fresh Attacks In Benue

Entertainment22 hours ago

Entertainment22 hours agoPhyna denied entry into Lagos restaurant over “Indecent” outfit