Top Stories

BREAKING: Money supply in Nigeria crosses N50 trillion in October 2022

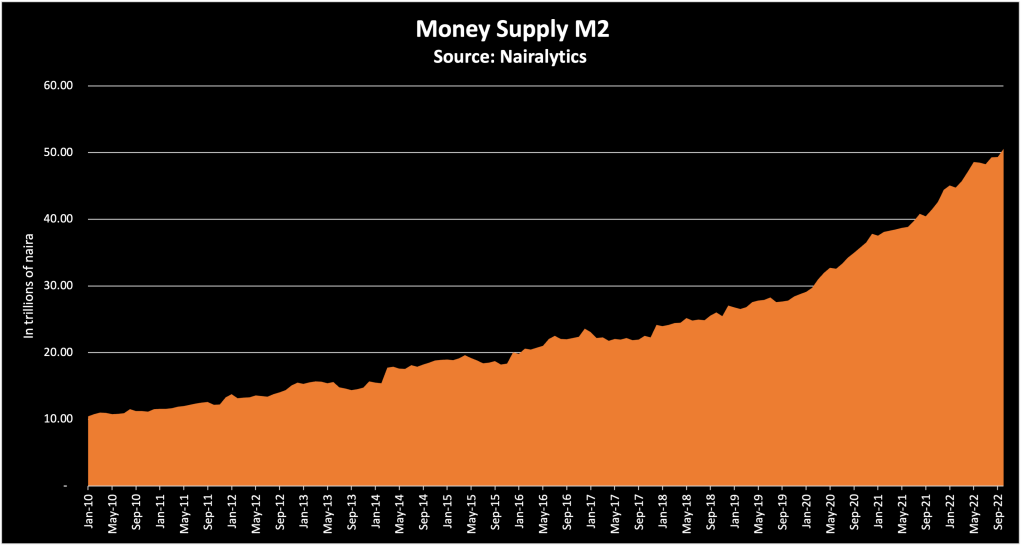

Data from the central bank of Nigeria reveals Money Supply otherwise termed M2 is now at a record high of N50.5 trillion as of October 2022.

This is the highest level ever reported for one of the most important monetary-related statistics tracked by Nigeria’s central bank or any central bank in the world. The increase in money supply was N1.26 trillion in October alone, the third highest month after April and May this year.

The amount of money supply in the country has risen by N6.1 trillion this year alone having closed at N44.4 trillion at the end of 2021. The increase is on track to beat the N6.6 trillion achieved in the whole of 2021.

Why this matters: An increase in the level of money supply in an economy is meant to deliver two major actions.

- It can help spur economic growth in the country as an increase in the supply of money in a depressed economy or one experiencing recession is often seen as a remedy.

- On the other hand, excessive money supply growth can trigger galloping inflation in any country forcing a reversal of strategy.

- While Nigeria has avoided a recession, the country is experiencing rising inflation which suggests that excessive money supply is a major concern that requires urgent fixing.

What you should know: The amount of money in supply has accumulated over the years largely due to the low-interest policy of the CBN (adopted to spur economic growth), trillions of naira in CBN intervention funds, and CBN bailouts of federal and state governments via its Ways and Means powers. The result is too much naira chasing dollars.

- The money supply is largely made up of currency outside banks, demand deposits with banks, and investments.

- According to the data from the CBN, Quasi money which is money invested in liquid assets is about N29.2 trillion.

- Demand deposits, which are money held by banks on behalf of their customers are about N18.4 trillion. Demand deposits contributed N3.3 trillion to the N6.1 trillion rise experienced this year.

- Currency outside banks is about N2.8 trillion.

Coming up: The central bank’s monetary policy committee is set to meet on Monday and Tuesday, the 21st and 22nd of November respectively.

- The apex bank will likely respond to the latest data from the NBS which revealed the inflation rate at above 21%.

- The apex bank will consider the rising money supply in whatever decision it makes at the committee meeting. As stated, the money supply rose again in October despite efforts to curb it.

- Nearly all the N1.2 trillion increase in money supply for October came from Quasi money.

- Responding to another bout of higher monetary policy rates as well as raising CRR should not be unexpected.

News23 hours ago

News23 hours agoNIGERIAN BREWERIES PARTNERS OZA CARNIVAL

Top Stories11 hours ago

Top Stories11 hours agoTinubu’s Aide Condemns Plan To Reinstall ‘Jesus Is Not God’ Banner In Lekki Mosque

Top Stories6 hours ago

Top Stories6 hours agoBreaking: FIRS Announces Fresh Recruitment, See Eligibility Criteria, Application Deadline

News11 hours ago

News11 hours agoPetrol To Sell ₦935/Litre From Today – IPMAN

Top Stories11 hours ago

Top Stories11 hours ago2025 Budget Cannot Address Nigeria’s Economic Challenges – Atiku

Entertainment11 hours ago

Entertainment11 hours agoI will be more influential in Nigeria than UK – Tobi Adegboyega

News11 hours ago

News11 hours agoPresident Tinubu’s reforms not responsible for food stampedes – FG

Top Stories8 hours ago

Top Stories8 hours agoPrimate Ayodele’s Prophecies For 2025