Business and Brands

Coinbase faces ‘increased uncertainty and risks’ from FTX fallout, says analyst

Two analysts cut their price targets on Coinbase stock as the crypto world contends with implosion of FTX.

Coinbase Global Inc. “has little direct exposure to FTX,” but that doesn’t mean the cryptocurrency exchange is immune to the “contagion” brought on by FTX’s recent collapse, according to Needham analyst John Todaro.

While Coinbase COIN, +4.07% has just $15 million in crypto assets on the FTX platform, Todaro said he sees more big-picture risks to the crypto exchange stemming from FTX’s implosion.

In a note to clients, Todaro cautioned that although the FTX debacle has driven near-term volatility, increased volume and market-share gains for Coinbase, that momentum may be “relatively short-lived.” He said that he sees the potential for “dampened retail and [institutional] trading activity” into the first half of 2023.

“User fears over centralized exchange risks could lead to withdrawals,” he wrote. “While Coinbase is audited and maintains a 1:1 backing of user crypto assets, there is a heightened possibility of withdrawals as users pull assets off centralized exchanges. Bitcoin held on exchanges has declined to its lowest level since 2018.”

Additionally, he wrote that the U.S. government could make crypto regulation a greater priority starting in the first quarter of 2023, bringing the potential for stricter rules around exchanges, custodians and perhaps stablecoins.

“While this could turn out to be a positive catalyst for COIN, given its regulation status vs off-shore rivals such as Binance, overly strict regulation could limit DeFi [decentralized finance], NFTs, and other use-cases for crypto, which would reduce transaction volume, interest, and activity across the space,” Todaro wrote.

He cut his price target on Coinbase’s stock to $73 from $89 Tuesday while lowering his fiscal 2023 revenue estimate to $3.7 bullion from $4.7 billion.

Nonetheless, he maintained his buy rating on the stock and continues to like it over the long run.

Barclays analyst Benjamin Budish also weighed in on the impact of FTX’s collapse on Coinbase, saying he saw “minimal potential upside (low- to mid-single digit) to Coinbase trading revenues given the geographic overlap between the two companies, our capture assumptions, and early reads on where funds from FTX were flowing.”

He reduced his price target on Coinbase shares to $44 from $55 while maintaining an equal-weight rating.

Coinbase shares are up 1.4% in Tuesday morning trading, though they’ve lost 83% so far this year, while the S&P 500 SPX, 0.80% has declined 17% over the same span.

Top Stories8 hours ago

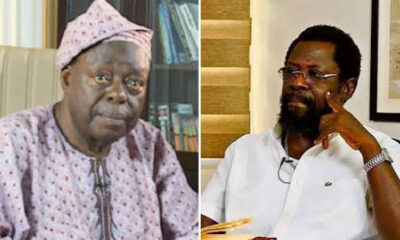

Top Stories8 hours agoDele Farotimi Speaks on Lying Against Afe Babalola After Gaining Freedom

News18 hours ago

News18 hours agoBREAKING: OZA CARNIVAL SECURES TOLARAM GROUP, ZENITH BANK PARTNERSHIPS

Politics8 hours ago

Politics8 hours agoPDP Picks Holes In President Tinubu’s Media Chat

Top Stories8 hours ago

Top Stories8 hours agoCourt Orders DSS To Release Miyetti Allah President Pending Trial

News8 hours ago

News8 hours ago100+ Merry Christmas Wishes and Prayers to Send to Family & Friends on Xmas 2024

Entertainment7 hours ago

Entertainment7 hours agoProphet Odumeje issues warning to those discrediting his miracles

Entertainment6 hours ago

Entertainment6 hours agoSeyi Edun wins hearts as she makes peace with Toyin Abraham, shows support for her new movie; Toyin reacts (Video)

Entertainment7 hours ago

Entertainment7 hours agoComedian AY Clarifies Claims Of Shading Funke Akindele, Toyin Abraham,Ladies In Hollywood