Business and Brands

FTX lawyers tell bankruptcy court the company became SBF’s ‘personal fiefdom’

Lawyers representing FTX in the firm’s Chapter 11 bankruptcy proceedings called the company’s swift demise earlier this month “the most abrupt and difficult collapse in the history of corporate America” in comments before a Delaware bankruptcy court Tuesday.

“Your honor, what we have is a worldwide organization that was run effectively as the personal fiefdom of Sam Bankman-Fried,” James Bromley, newly appointed counsel to FTX’s new management, said.

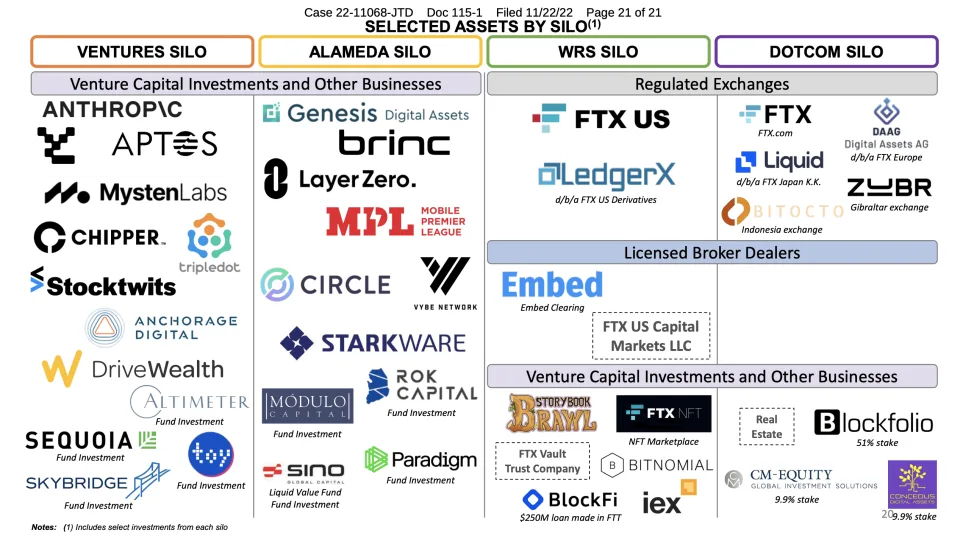

Substantial investments, according to Bromley and a presentation submitted to the court, indicate cryptocurrencies and technology were the company’s primary focus. FTX also made $300 million worth of real estate purchases in the Bahamas.

The crypto empire of roughly 130-affiliated companies built by 30-year old Sam Bankman-Fried slid from digital asset powerhouse into bankruptcy in a matter of days earlier this month.

In the hearing, FTX’s legal counsel also described the transition when founder and former CEO Sam Bankman-Fried signed over corporate control of FTX at petition date as an “emperor has no clothes moment.”

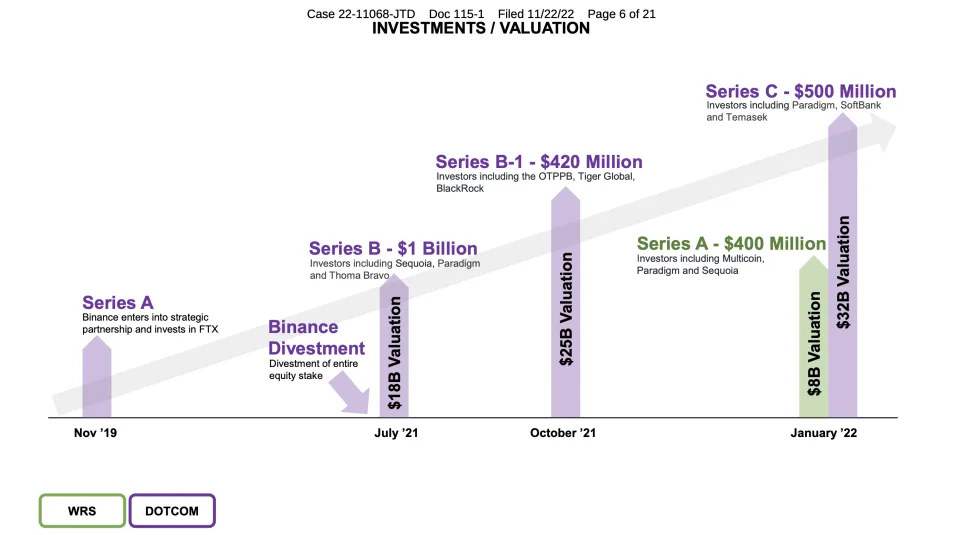

In January, FTX’s international exchange business alone carried a $32 billion valuation.

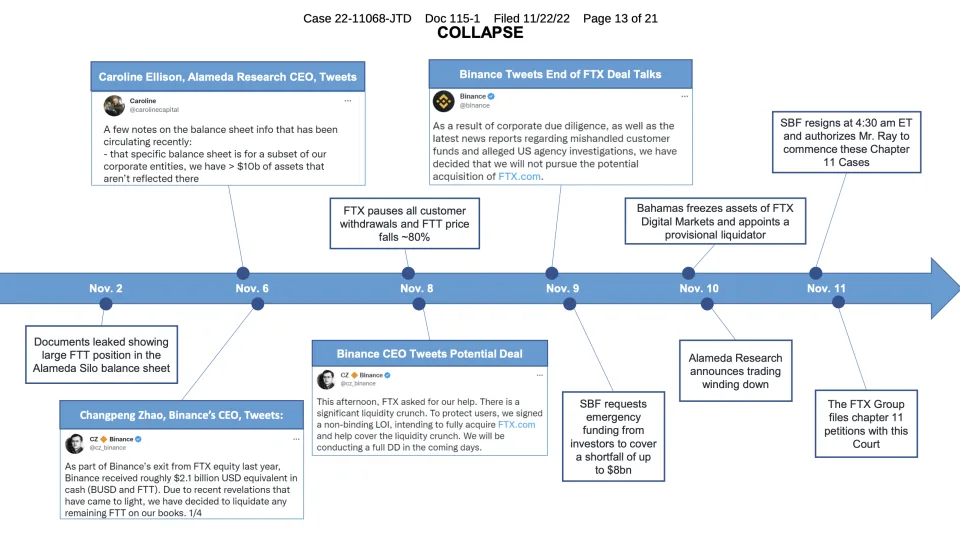

Before filing for Chapter 11 protection, the company’s founder and then-CEO Bankman-Fried reported liquidity problems, ordered the pause of customer withdrawals, and attempted to strike a deal with major exchange Binance before admitting “ultimately, hopefully” bankruptcy could be better for customers.

This chain of events followed initial fears sparked from a leaked financial statement reported by Coindesk on November 4, which showed the majority of assets held by FTX’s sibling trading firm and market maker Alameda Research were issued by FTX, suggesting Bankman-Fried’s empire was being propped up by a relationship between the two entities.

The four silo structure liquidators have come to use to describe Bankman-Fried’s empire includes West Realm Shires (FTX US), Alameda, ventures investments, and the international exchange “FTX.com.”

During the hearing, the FTX legal team also highlighted the company has a $1.24 billion cash balance and said it is working with an international range of financial investigators to locate and safeguard the company’s remaining assets.

Submitted late Monday night by FTX’s financial advisers, Alvarez & Marsal, the cash amount is “substantially higher” than what FTX’s newly appointed CEO John J. Ray III and team initially anticipated.

A first stab estimate from Ray and his team recorded a total $564 million in cash, adding the company’s “historical cash management failures” had prompted the new team to build FTX’s cash management from scratch.

A slap dash spreadsheet shared the day before its November 11 bankruptcy petition showed FTX also carried a massive balance sheet gap between customer deposits and liquid assets. According to that document, the company held approximately $900 million in liquid crypto and $5.4 in illiquid venture capital investments against $9 billion in liabilities.

As if financials could not look worse, hackers as much as drained $477 million from FTX-owned crypto wallets shortly after its petition date.

Adding to some confusion, the Securities Commission of the Bahamas directed the transfer of digital asset holdings for FTX Digital Markets, a subsidiary the nation has claimed jurisdiction over, to a wallet for safekeeping around the same time, the regulator later said.

Cryptocurrencies and other industry firms have since plunged into a tail-spin of historic proportions with the total market capitalization having declined by 18% since November 4 to $800 billion, bringing year-to-date losses for crypto assets this year to 63%, per data from Coinmarketcap.

—

News16 hours ago

News16 hours agoNIGERIAN BREWERIES PARTNERS OZA CARNIVAL

Top Stories3 hours ago

Top Stories3 hours agoTinubu’s Aide Condemns Plan To Reinstall ‘Jesus Is Not God’ Banner In Lekki Mosque

Top Stories4 hours ago

Top Stories4 hours ago2025 Budget Cannot Address Nigeria’s Economic Challenges – Atiku

News4 hours ago

News4 hours agoPetrol To Sell ₦935/Litre From Today – IPMAN

News4 hours ago

News4 hours agoPresident Tinubu’s reforms not responsible for food stampedes – FG

Entertainment4 hours ago

Entertainment4 hours agoI will be more influential in Nigeria than UK – Tobi Adegboyega

Top Stories48 minutes ago

Top Stories48 minutes agoPrimate Ayodele’s Prophecies For 2025