Top Stories

Crypto exchange war: Binance questions Coinbase reserves

Shots were exchanged between the two largest cryptocurrency exchanges when Binance openly questioned the robustness of Coinbase’s (COIN) reserves.

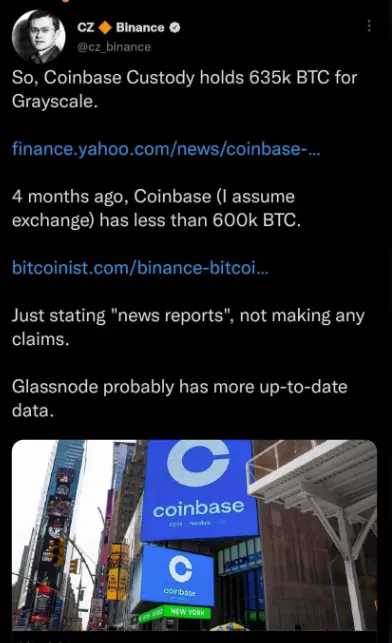

Binance CEO Changpeng “CZ” Zhao called out the world’s second-largest crypto-exchange over its reserves assets.

On Tuesday, Zhao said on Twitter: “Coinbase Custody holds 635,000 BTC (BTC-USD) on behalf of Grayscale.

“4 months ago, Coinbase (I assume exchange) has less than 600K”. Zhao provided a link to a 4-month-old article from Bitcoinist stating Coinbase only had 600,000 BTC.

He retracted his statement after Coinbase CEO Brian Armstrong hit back with a swift response.

Zhao made it clear that he was simply quoting “news reports,” and not making any claims of his own.

However, Armstong dismissed his tweet as “FUD” (fear, uncertainty and doubt).

Armstrong tweeted back in defence: “If you see FUD out there — remember, our financials are public (we’re a public company)”.

The Coinbase CEO backed up his response by revealing the totality of Coinbase’s bitcoin reserves.

Armstrong added: “We hold ~2M BTC. ~$39.9B worth as of 9/30 (see our 10Q).”

Zhao quickly deleted his tweet, but such an influential actor in the crypto-industry casting doubt over a rival’s balance sheet could cause reputational damage.

It comes after Zhao inflamed a bank run on Sam Bankman-Fried’s FTX cryptocurrency exchange with a tweet stating that Binance would liquidate its holdings in FTX’s native FTT (FTT-USD) token.

FTX was backed by FTT, which was often described as the “backbone” of the exchange.

FTT was sold at low prices to Alameda Research and the trading arm of the exchange was heavily stacked with FTX’s token, to the tune of $3.66bn (£3.05bn) “unlocked FTT” and $2.16bn “FTT collateral” as assets.

When FTX artificially inflated the value of FTT, Alameda was able to use FTT as collateral for trading on the FTX exchange.

Before the implosion of FTX and Alameda Research, Cory Klippsten, CEO of investment platform Swan Bitcoin, said: “It’s fascinating to see that the majority of the net equity in the Alameda business is actually FTX’s own centrally controlled and printed-out-of-thin-air token”.

Coindesk journalist Ian Allison blew the lid on the irregularities in Alameda Research’s balance sheet which showed that of the $14.6bn of assets held by Alameda Research, a large proportion was in FTX’s own FTT token.

The coin that can be freely created by FTX dominated the reserves that Alameda Research used as collateral for loans.

With outstanding liabilities of an estimated $5.1bn at Alameda Research, holders of FTT experienced rising panic that margin calls on those loans might decimate the value of FTX’s native token.

Zhao held a substantial amount of FTT before tweeting on 6 November that Binance would liquidate its holdings.

Zhao tweeted: “Liquidating our FTT is just post-exit risk management, learning from LUNA.

“We gave support before, but we won’t pretend to make love after divorce. We are not against anyone. But we won’t support people who lobby against other industry players behind their backs. Onwards.”

Zhao’s announcement that he planned to sell the billions of FTT held by Binance sent the value of the cryptocurrency into an unrecoverable tailspin.

FTT reached an all-time high of $85 in September 2021, but after the dramatic collapse of the FTX exchange, it is now struggling to breathe at $1.33.

Top Stories14 hours ago

Top Stories14 hours agoBREAKING: EFCC freezes over 300 accounts over suspicious FX flows

Top Stories14 hours ago

Top Stories14 hours agoEx-Imo Gov, Ihedioha Dumps PDP, Gives Reason

Politics14 hours ago

Politics14 hours ago“If I do not see the Yahaya Bello case to the end, I will resign” – Olukoyede

News1 hour ago

News1 hour agoFG Summons Lead British School Management Over Bullying

Top Stories1 hour ago

Top Stories1 hour agoYahaya Bello: Do Not Allow Yourself Become A Tool Of Political Vendetta And Intimidation – Kogi Assembly To EFCC

Sports45 mins ago

Sports45 mins agoNBA playoffs: Timberwolves cruise past Suns for 2-0 lead despite off night from Anthony Edwards, Karl-Anthony Towns

Top Stories1 hour ago

Top Stories1 hour agoEFCC slams fresh charge on Emefiele for printing N684.5m with N18.9bn

Politics1 hour ago

Politics1 hour agoOdodo Committed Criminal Offence By Aiding Yahaya Bello’s Escape -Sagay