Sponsored Posts

FTX Collapse: Binance Stores $2 Billion to Save Struggling Firms

Binance,the world’s largest cryptocurrency exchange and its founder Changpeng Zhao pose as saviors of the crypto industry.

The abrupt collapse of FTX continues to reverberate through the cryptocurrency industry.

While it is still very early to determine the full repercussions of Sam Bankman-Fried’s crypto empire filing for bankruptcy, it is expected that there are going to be many victims in the crypto sphere, according to industry sources.

The reasoning is that FTX, the cryptocurrency exchange, which was still valued at $32 billion in February, was a central player in the crypto chessboard. So was its sister company Alameda Research, a hedge fund and trading platform, also founded by Bankman-Fried.

In the summer of 2022, the two firms had emerged as industry saviors, after the collapse of sister cryptocurrencies Luna and UST caused a credit crunch which rocked many firms exposed to their Terra ecosystem. Hedge fund Three Arrows Capital (3AC) was forced into liquidation, while crypto lenders Celsius Network and Voyager Digital filed for bankruptcy. Bankman-Fried bailed out many companies, including lender BlockFi, brokerage RobinHood and others.

‘Another $1 Billion’

Now that FTX is down, there is no doubt that many firms will be impacted. Lender BlockFi and brokerage Genesis have already suspended cash withdrawals by their customers. To avoid a systemic crisis, Changpeng Zhao, the founder and CEO of Binance, the world’s largest cryptocurrency exchange, has announced a fund to help companies facing financial difficulties.

Details on how this fund will work have not yet been provided. But Zhao, who now appears to be the big winner from the fall of Bankman-Fried, has just revealed that Binance is allocating $2 billion to this fund.

“Yesterday, #Binance allocated ANOTHER $1 billion to the industry recover initiative. All in BUSD,” Zhao posted on Twitter on November 25.

This announcement comes a day after a first piece of news, given by Zhao during an interview with Bloomberg News. In that interview, he announced that Binance had already allocated $1 billion to the rescue fund.

“If that’s not enough we can allocate more,” Zhao told the news outlet.

“To reduce further cascading negative effects of FTX, Binance is forming an industry recovery fund, to help projects who are otherwise strong, but in a liquidity crisis,” Zhao first said on November 14. “More details to come soon. In the meantime, please contact Binance Labs if you think you qualify.”

Binance Labs is the financial arm of Binance.

Zhao has also decided to open this fund to other players and investors who would like to help the crypto industry. Aptos Labs and Jump Crypto will contribute to the fund.

The Fall of FTX

History will remember that it was the decision of Zhao and Binance to sell $530 million worth of FTT, the cryptocurrency issued by FTX, which was the beginning of the end for the Bankman-Fried empire. Indeed, after the announcement of this decision on Twitter on November 6, there followed a run on the platform of panicked FTX customers. Five days later, the firm was bankrupt, after Binance had given up on acquiring it two days earlier.

As a crypto exchange, FTX executed orders for their clients, taking their cash and buying cryptocurrencies on their behalf. FTX acted as a custodian, holding the clients’ crypto currencies.

FTX then used its clients’ crypto assets, through its sister company’s Alameda Research trading arm, to generate cash through borrowing or market making. The cash FTX borrowed was used to bail out other crypto institutions in the summer of 2022.

At the same time, FTX was using the cryptocurrency it was issuing, FTT, as collateral on its balance sheet. This represented a significant exposure, due to the concentration risk and the volatility of FTT.

Once this exposure came to light, clients, fearing an FTX collapse, rushed to liquidate their crypto positions and get their money back. On November 6, Customers withdrew a record $5 billion in a run on the exchange. This led to the insolvency of FTX, as it did not have the crypto assets, now on loan or sold, to honor its clients’ sell orders.

Top Stories6 hours ago

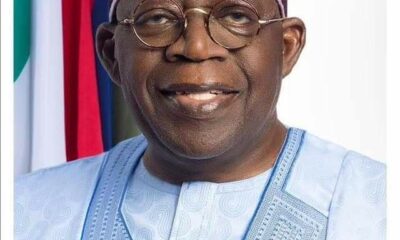

Top Stories6 hours agoI’m not prepared to downsize my cabinet — Tinubu

News6 hours ago

News6 hours agoBREAKING: “I Have No Regrets” – Tinubu Defends Fuel Subsidy Removal Amid Economic Hardship [VIDEO]

Top Stories27 minutes ago

Top Stories27 minutes agoBreaking: Ibadan Stampede: Court Orders Remand Of Ooni’s Ex-Wife, School Principal

Entertainment3 hours ago

Entertainment3 hours agoJay-Z has no ‘plans to show loyalty to longtime friend Diddy’ as he battles r@pe allegation

Sports2 hours ago

Sports2 hours agoGOAT: Who said Messi is better than me – Cristiano Ronaldo

Politics5 hours ago

Politics5 hours agoI will not downsize my cabinet — Tinubu vows

Entertainment2 hours ago

Entertainment2 hours agoRegina Daniels reveals the best way to predict one’s future as she shares more photos from her vacation

Breaking News5 hours ago

Breaking News5 hours agoNaira appreciates massively against dollar ahead Christmas holidays