Top Stories

Why Bitcoin price is rising again

Bitcoin reached a high of $20.9k on Saturday, leaving short sellers who bet against its ascent in the red.

The flagship Cryptocurrency has been on the rise all week as recent positive macroeconomic reports breathe life into a largely depressed market.

Data from CoinGecko shows that the price of bitcoin hasn’t been this high since early November, just before the stunning collapse of FTX.

- The overall market capitalization of the cryptocurrency sector currently stands at $990 billion, a rise of more than 4% over the previous day, indicating that the market is also showing signs of life.

- In the previous day, cryptocurrency transactions totaled more than $80 billion.

- Traditional markets also saw gains for the week, with the S&P 500 rising more than 2% as Q4 earnings season got underway and U.S. inflation numbers—while still elevated—kept falling. The first monthly inflation reduction in 2.5 years as well as more substantial annual declines in both the headline and core readings have added to the optimism.

Why the rise: Bitcoin prices began its surge earlier in the week in anticipation of the release of the Federal Reserve’s December Consumer Price Index report.

- Monday marked the beginning of the week’s trading for bitcoin, which has since continued to rise. The CPI report confirmed that inflation in the US economy is really dropping while also meeting market expectations.

But, none of this ensures that this year will be favorable for risk assets, but it does indicate that things will appear much more normal than they did last year.

- Even though the macroeconomic environment may have improved, the outlook for bitcoin businesses is bleak.

- Metropolitan Commercial Bank (MCB), a New York-based institution, said on January 9 that it would shut down its crypto-assets sector, citing recent market losses and changes in the legal environment as reasons. 6% of the bank’s total deposits came from customers who were involved in the crypto industry.

With Bitcoin up 16% since the beginning of 2023, derivatives analytics show little indication of demand from leveraged short sales or defensive put options.

- Bears are still patiently waiting for an entry point for their short positions, despite the fact that bulls can rejoice that the $900 billion total market capitalization resistance faced no opposition.

- Still, Crypto Bulls’ major hope is still a good macroeconomic environment, which is mostly dependent on how U.S retail sales statistics come out next week given the market’s unfavorable newsflow.

Meanwhile, About 12,621 traders were liquidated on that day, totaling $650.99 million in liquidations. The greatest single liquidation order, worth $6.84 million, was placed on Huobi.

- Why Shortsell? The goal of shorting bitcoin is to borrow the asset when the price is high and then sell subsequently.

- They then buy back if the asset falls and return to who they borrowed from.

- The spread is then pocketed as profit by the short seller.

The U.S. Securities and Exchange Commission (SEC) accused Gemini and cryptocurrency exchange Genesis Global Capital of selling unregistered securities through Gemini’s “Earn” program on January 12.

- A new round of staff layoffs announced by Crypto.com on January 13 that resulted in a 20% reduction in the global workforce was the final blow. Kraken, Coinbase, and Huobi are a few other cryptocurrency exchanges that just announced employment losses within the past month.

Top Stories13 hours ago

Top Stories13 hours agoCourt Freezes $225 million in assets linked to General Hydrocarbons and Nduka Obaigbena

Entertainment12 hours ago

Entertainment12 hours agoIbrahim Chatta celebrates as baby mama, Olayinka Solomon welcomes first child with husband

Entertainment12 hours ago

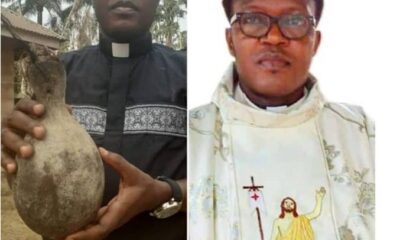

Entertainment12 hours agoAnambra Catholic priest quits priesthood after 17 years; embraces traditional religion and gets married

Top Stories14 hours ago

Top Stories14 hours agoTelecoms tariffs will soon be increased, but not by 100% – Bosun Tijani

News13 hours ago

News13 hours agoEx-IG of Police, Okiro withdraws from Ohanaeze presidential race

News4 hours ago

News4 hours agoFirstBank targets new frontiers in Ethiopia, Angola, Cameroon

Top Stories4 hours ago

Top Stories4 hours agoBREAKING: Seyi Makinde approves Owoade as new Alaafin of Oyo

Politics4 hours ago

Politics4 hours agoBREAKING: Court vacates Order nullifying Sanusi’s reinstatement as Emir