Tech

Student loans: Biden vetoes bill to claw back student loan relief

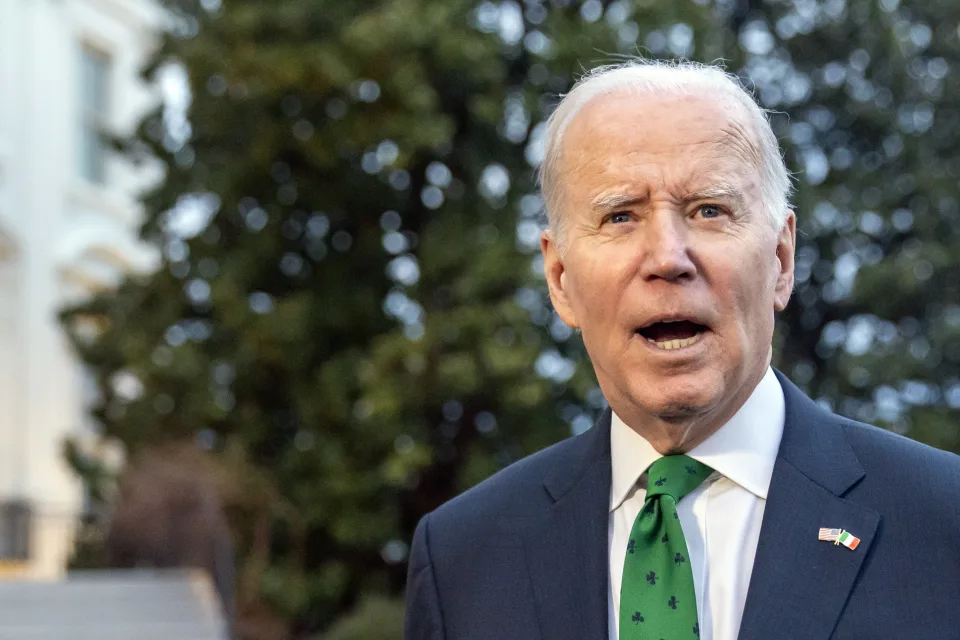

President Joe Biden on Wednesday vetoed a bill that would have repealed months of student loan payment forbearance and banned his up to $20,000 in debt forgiveness — regardless of how the Supreme Court rules on the legality of the program this month.

The resolution, called House Joint Resolution 45, passed the House in May and the Senate last week, with support from Sen. Kyrsten Simena (I-Ariz.) and two Democrats, Sens. Joe Manchin (D-W.Va.) and Jon Tester (D-Mont.), in the higher chamber.

If Biden had not vetoed the measure, borrower advocates worried that 40 million student loan borrowers could have faced backpay for those paused payments and had new interest charges added to their debt. They also raised concerns that debt cancellation borrowers recently received would be reversed.

“It is a shame for working families across the country that lawmakers continue to pursue this unprecedented attempt to deny critical relief to millions of their own constituents,” President Biden said after vetoing the resolution. “I remain committed to continuing to make college affordable and providing this critical relief to borrowers as they work to recover from a once-in-a-century pandemic.”

What now?

The measure is likely dead now.

“It did not pass the House and Senate with enough votes to override a presidential veto, so borrowers do not need to worry about it,” Mark Kantrowitz, author and student loans expert, told Yahoo Finance. “This was motivated by political posturing, as the people behind it knew that it would not survive a veto.”

Still, the Senate’s passage shocked borrower advocates after the White House agreed to not extend forbearance and that paused student payments would restart in September in a debt ceiling deal with House Speaker Kevin McCarthy (R-Calif.).

Borrower advocates hoped the ability to extend the forbearance pause was a plan B if the Supreme Court rules against student loan cancellation. However, the debt ceiling agreement takes that option off the table.

In the meantime, borrowers should prepare for repayments to begin in September by making sure their information is updated with the Federal Student Aid (FSA), using studentaid.gov.

“The most important thing borrowers can do right now is certify our income, so that we are enrolled in [an] income-driven repayment plan,” Katherine Lucas McKay, associate director of insights and evidence of the Financial Security Program at The Aspen Institute, told Yahoo Finance. “That should be a top priority for anyone who is worried about restarting their payments.”

News13 hours ago

News13 hours agoNIGERIAN BREWERIES PARTNERS OZA CARNIVAL

Top Stories1 hour ago

Top Stories1 hour agoTinubu’s Aide Condemns Plan To Reinstall ‘Jesus Is Not God’ Banner In Lekki Mosque

Top Stories2 hours ago

Top Stories2 hours ago2025 Budget Cannot Address Nigeria’s Economic Challenges – Atiku

News1 hour ago

News1 hour agoPetrol To Sell ₦935/Litre From Today – IPMAN

News1 hour ago

News1 hour agoPresident Tinubu’s reforms not responsible for food stampedes – FG

Entertainment1 hour ago

Entertainment1 hour agoI will be more influential in Nigeria than UK – Tobi Adegboyega