Top Stories

The story of FirstBank’s transformation under Adeduntan

The story of FirstBank’s transformation under Adeduntan

FBN Holdings, Nigeria’s oldest financial institution released its much-awaited 2022 financial year (FY) year results in June 2023 showing that the owner of FirstBank reported a profit after tax of N136.3 billion.

The group also reported a gross earnings of N805.1 billion up from N757.3 billion in the same period in 2021.

In the first quarter of 2023 FY, which was marred economically by the naira scarcity and the 2023 general elections, the bank reported a pre-tax profit of N56.1 billion up 53.6% year on year.

Speaking about the bank’s recent performance, the bank’s Managing Director and Chief Executive Officer, Adesola Adeduntan, identified its investments in technology, transaction, and digital banking as a key differentiator from its peers.

- “As a Group, we continue to reap the benefits of our investments in technology, transaction and digital banking capabilities which enable us to offer better customer experiences to our numerous clients. This was further reflected in the impressive 22.4% and 28.5% year-on-year growth in customers’ deposits and loans respectively, demonstrating customers’ confidence in our service delivery and value proposition.”

Reflecting on the recent performance of the group’s banking division, it is important to recognize the significant progress made since the challenging times faced a few years ago by the tier-one bank.

We cast our minds back to April 2016 when the bank announced that its profit after tax had plummeted by a staggering 82% to N15.1 billion, and the NPL ratio surged to a concerning 18.1%.

For Adeduntan, who had just been appointed MD/CEO, leading a tier-one bank was a significant departure from his previous experiences.

While he had held leadership roles at the African Finance Corporation and Citibank Nigeria, the task of spearheading FirstBank—the flagship institution of FBN Holding—was altogether a different challenge.

FirstBank, with its illustrious 129-year history, demanded a visionary, agile, and results-oriented leader who could transform it into a modern powerhouse while staying true to its heritage.

From Credit to transactions

FBN Holdings’ challenges had been brewing long before Adesola Adeduntan assumed the role of an executive director at FirstBank.

As one of Nigeria’s largest banks, it played a pivotal role in financing major private and government-led ventures within Africa’s largest economy.

FirstBank spearheaded syndicated funding for a diverse range of transactions spanning sectors such as oil and gas, power, infrastructure, manufacturing, and agriculture.

The oil price surge from 2011 to mid-2014 propelled Nigeria’s economy, and domestic businesses invested billions in expansion projects, including acquiring oil blocs previously held by international oil majors.

FirstBank was intimately involved in these transactions, extending billions of Naira in loans to facilitate these acquisitions.

The bank’s financial performance seemed justified as its profit before tax nearly tripled from N33 billion in 2010 to N93.9 billion in 2012.

In the subsequent years, it recorded profits of N91 billion and N93.4 billion, accumulating a staggering N278 billion in pre-tax profits over a three-year period.

However, the bubble burst in 2015, leaving Adeduntan with a stark realization that rapid change was imperative for the bank’s survival.

Drawing from his experience at Citibank, he recognized the need to shift First Bank’s focus from being “credit-led” to becoming “transaction-led”—a strategic pivot that would redefine its approach to banking.

The bank’s turnaround in its business model has been deliberate in its planning and in its execution, pivoting from a ‘do it all’ bank to one that is transaction led.

- “FirstBank was renowned for its ability to put N20 billion on the table for any transaction,” he reflected.

The Transformation journey

Transforming a banking giant like FirstBank from a traditional lender into a facilitator of transactions was a monumental task.

It demanded substantial investments in technology and workforce development, as well as a fundamental shift in the corporate mindset, not only within the bank but also at the group level.

In 2015, FirstBank’s historical data painted a stark picture of its realities. Its flagship mobile banking platform, FirstMobile, had a mere 60,000 users, while FirstOnline, the online banking platform, had only 90,000 users.

The total number of digital banking customers stood at a paltry 600,000. The bank’s presence in the corporate e-bills payment market and transaction banking platform was virtually nonexistent.

Annual transaction volumes hovered around 2 billion, and non-interest income accounted for a meager 22.7% of net revenue. At the time, the bank boasted approximately 10.9 million customer accounts, highlighting the bank’s distance from achieving a transaction-led approach.

To achieve the desired transformation, Adeduntan emphasized the need to build a robust transaction processing platform across both retail and wholesale segments of the business.

In 2015, the group’s computer software expenditure stood at around N10.8 billion. By 2017, this figure had doubled to N24.2 billion, and the bank’s 2022 FY results indicated a further increase to approximately N54.2 billion.

Adeduntan proudly disclosed that “over 85% of the bank’s customer-initiated transactions are now conducted online.”

Between 2015 and 2022, the bank’s digital-centric transaction strategy bore fruit.

Total customer numbers surged fourfold to over 41 million, while the number of issued cards rose from 7 million to 12 million.

FirstMobile and FirstOnline users reached 6.1 million and 1.1 million, respectively, while USSD users skyrocketed from 0.5 million to 14.7 million.

FirstBank now commands a 42% market share for corporate e-bills payments, and annual transaction volumes have reached a staggering 17 billion.

The momentum and growth in transactions, reflected in non-interest income as a percentage of net revenue, climbed to 40.59%.

Income from electronic banking fees also experienced substantial growth, surging from N21.8 billion in 2015 to N55 billion in 2022.

Adeduntan’s strategic pivot proved successful, effectively transforming the bank from a brick-and-mortar institution into a brick-and-click powerhouse.

More than just Nigeria

Over the past seven years, FirstBank achieved notable success with its overseas operations, overcoming the challenges associated with its subsidiaries, which had previously incurred losses.

Despite being a pan-African bank, optimizing these subsidiaries proved to be a significant hurdle. Apart from the losses, the bank also grappled with high NPL ratios.

In 2015, the bank’s total group revenue amounted to N502.6 billion, with its business outside Nigeria contributing N51.8 billion or 10% of the total.

However, by 2022, operations outside Nigeria had significantly improved, contributing 17% to the group’s revenues, with a remarkable reduction in NPL to just 1%.

Adeduntan attributed this success to the bank’s deliberate and strategic approach to its overseas operations.

As a result, FirstBank was able to minimize the impact of Ghana’s bond restructuring compared to other Nigerian banks.

While some Nigerian banks suffered losses amounting to tens of billions, FirstBank’s hit was limited to just N5.9 billion.

Notably, tier-one banks, excluding FirstBank, collectively incurred losses of approximately N284 billion due to the Ghanaian bond default.

The bank’s astute approach to overseas operations and enterprise risk management played a vital role in its resilience and comparatively better performance.

Although Adeduntan did not divulge specific details regarding how the bank avoided the magnitude of losses experienced by other banks, he emphasized the deployment of an ingenious enterprise risk management framework that shielded the bank from potential pitfalls such as the bond default.

For FirstBank UK and its other African subsidiaries, the bank assumed full control over strategy design, aligning it with the overarching strategic direction of FirstBank.

They redefined their risk appetite and revitalized the risk management architecture to ensure robust safeguards were in place.

In addition to risk management measures, FirstBank prioritized the strategic selection of board members, particularly for its foreign subsidiaries. Adeduntan highlighted the bank’s commitment to strengthening governance by appointing directors based on merit rather than patronage.

Notable examples include the appointment of a former Executive Director/Chief Risk Officer of the Nigeria Sovereign Investment Authority (NSIA) to oversee the bank’s Pension Custody Business and the inclusion of a former Chief Risk Officer of Standard Chartered Bank Nigeria on the DR Congo Board.

By reinforcing governance and assembling a skilled and diverse board, FirstBank aimed to enhance oversight and decision-making, aligning the expertise of its directors with the specific needs and opportunities within each subsidiary.

These measures contributed to the bank’s overall resilience and solidified its position in navigating the complexities of its foreign operations.

By navigating the challenges and effectively managing its subsidiaries, FirstBank demonstrated its ability to adapt and thrive in diverse markets outside Nigeria.

The bank’s African subsidiaries have gone from negative contribution to contributing 21.3% of pre-tax profits.

Round Peg in round holes

Delving deeper into the details of the transformation efforts undertaken by Adeduntan and his team, he emphasized the significance of assembling the right team—a team that could put the round peg in the right hole.

Recognizing the critical role of talent in driving change, particularly in a well-established institution like FirstBank, Adeduntan drew upon his own experiences and values.

He often harked back to his humble days at the University of Ibadan, where he learned the virtues of humility, resilience, and relationship-building.

Referring to himself as a “raw UI graduate,” Adeduntan highlighted the formative impact of his training at Anderson and Citibank, where he gained exposure to various soft skills that have shaped his character today.

Determined to instill soft skills in his team, Adeduntan sought individuals who viewed banking as an art, not just a career, emphasizing the importance of attire, public speaking, and the art of deal-making.

Upon assuming the role of MD/CEO of FirstBank, just 14 months after joining the organization, Adeduntan realized that the existing career trajectory within the bank, which could take up to 35 years to reach the top, would not facilitate the necessary change.

Consequently, he initiated a talent acquisition program that focused on employing STEM graduates, whom the bank could mold into future leaders.

Middle-level managers were also prioritized for development and leadership acceleration programs, preparing them to be true leaders rather than just bankers.

Adeduntan also embraced external recruitment, which he believed was essential for achieving the swift turnaround the bank aspired to.

In the present day, the average age of employees at the bank hovers around 38, with less than 10% of the workforce being older than 50. To place this into context, in general, employee mix, Baby Boomers make up 1%; Gen X – 37%; Millennials – 61%; Gen Z- 1%.

Adeduntan also assumed the position of Managing Director/Chief Executive Officer of the bank at the age of 46, and he became a General Manager at 37 during his tenure at Citibank.

Reflecting on his own career trajectory, he emphasized that high-performing individuals “high fliers” at the bank can accomplish in two years what would typically take regular staff ten years to achieve within the organization.

Adeduntan holds business schools in high regard, considering them a phenomenal learning experience. He believes that pursuing education at a business school is a prerequisite for those aspiring to attain executive management positions in a transformative organization.

By equipping themselves with the knowledge and skills imparted in business schools, individuals can enhance their capabilities and contribute to the success of the bank’s transformative journey.

Gender equality is also huge on the company’s core values epitomized by up to 32% board representation for women in the bank.

He also reveals 40% of the company employees are female and they get equal compensation with their male counterparts.

Stability in leadership

Approaching his eighth year as MD/CEO, Adeduntan acknowledges the positive impact that stability in leadership has had on FirstBank.

Prior to his tenure, the bank had a policy of limiting the MD/CEO’s term to three years without an option for renewal, which he believes contributed to the bank’s troubled years.

In early 2022, when his tenure was set to end, the central bank intervened and insisted that he remain at the helm.

This decision affirmed Adeduntan’s successes and allowed him to continue leading the bank for another three years of its transformation journey.

With the support of both the apex bank and its shareholders, Adeduntan has a strong foundation to drive the bank’s ongoing transformation.

Cost optimization is key to unlocking value

Transformation comes with significant costs which Adeduntan also acknowledges.

FirstBank has traditionally not been one of the most cost-efficient banks when measured with the industry-standard, cost-to-income ratio.

In 2015 the bank’s cost-to-income ratio was around 55% but increased to 61.7% in 2022.

The bank targets a 58% cost-to-income ratio for 2024 which it believes is achievable since just two years earlier in 2021 it achieved 56.4%.

Some of its opex drivers are due to the size of the bank making it difficult to reduce costs faster than anticipated.

Rising inflation and regulatory cost have also impacted costs. The bank recognizes it can achieve its target by also increasing its operating income faster than operating expenses.

In the 2022 FY, FirstBank demonstrated a strong focus on revenue optimization, leading to a remarkable 59% increase in net interest income, which reached N363.2 billion.

Despite this aggressive growth, the bank successfully maintained its operating expenses, limiting them to a 9% increase—a figure significantly below the average inflation rate of 20%.

While Adeduntan emphasizes the bank’s transactional approach to growth, lending remains a pivotal component of its business model and a key driver of its expansion.

Loans and Advances witnessed a substantial surge of 31.5% in 2022, reaching N3.78 trillion—double the balance recorded in the 2015 FY, which stood at N1.8 trillion. Impressively, the bank created N1 trillion in new loans in 2022 FY alone.

Adeduntan explains that FirstBank has evolved from merely issuing loans, to strategically building an ecosystem of transactions around its loan-creation activities.

By so doing, the bank not only generates interest income from lending but also leverages the opportunity to provide unique services to borrowers, earning fees and commissions in the process.

This approach enables FirstBank to unlock additional value and enhance its revenue streams while fostering deeper engagement with its customers.

Value in fundamentals

While Adeduntan has achieved significant success in turning around the bank’s profitability, shareholders also consider the bank’s share price as an important performance indicator.

When he assumed the position, FirstBank’s shares were trading at just N4 per share.

However, in the last one year, the bank’s shares have more than tripled in value to approximately N16. Despite this increase, the bank’s shares still trade at a discount to their book value.

Adeduntan recognizes that the challenge of low valuation multiples is not unique to FirstBank, but rather a global phenomenon that reflects investor sentiment towards tech stocks over more traditional and established businesses.

He believes the bank should be evaluated based on its intrinsic value, pointing to the improved return on average equity of 15.2% achieved by the Commercial Banking Group in 2022.

Additionally, the bank maintains a healthy capital adequacy ratio of 16.8% and a low cost of risk at just 1.7%. Despite the challenges faced over the years, the bank has consistently paid dividends to its shareholders.

Adeduntan is proud to note that the bank has not raised any additional capital, even after writing off over N1.2 trillion in non-performing loans in the past decade. He compares their approach to that of the Asset Management Corporation of Nigeria (AMCON).

Most of the bank’s innovations and transformative initiatives have been organic, requiring no additional burden on shareholders.

However, he acknowledges that as Basel III requirements approach, capital injections may be necessary not only for FirstBank but for the Nigerian banking system as a whole.

Top Stories6 hours ago

Top Stories6 hours agoEFCC denies release of list of Ex-Govs under N2.187 trillion corruption probe

News13 hours ago

News13 hours agoTop Nigerian Newspaper Headlines For Today, Sunday, 5th May, 2024

Top Stories11 hours ago

Top Stories11 hours agoZENITH BANK, AfCFTA LAUNCH INNOVATIVE SMART TRADE PORTAL

News11 hours ago

News11 hours ago‘North won’t support Tinubu’s second term, there’ll be gang-ups – Primate Ayodele

Top Stories11 hours ago

Top Stories11 hours agoBread prices rise as bakers grapple with over 100% jump in input costs

News6 hours ago

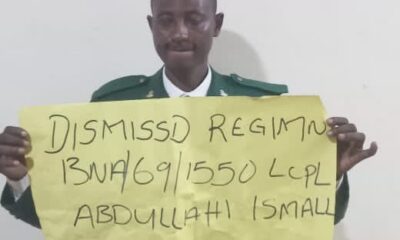

News6 hours agoNigerian Army suspends Soldier for sleeping with Colleague’s Wife

Sports11 hours ago

Sports11 hours agoNigerian men’s 4x400m team run fastest time in 20 years to qualify for the Paris 2024 Olympics

Business and Brands10 hours ago

Business and Brands10 hours agoGTCO records largest ever first quarter profit in Nigerian Banking History