Business and Brands

Top 10 Mutual Fund Asset Managers in Nigeria

When it comes to investing, mutual funds are becoming a popular choice for both individual and institutional investors in Nigeria.

These funds pool money from various investors and invest in a diversified portfolio of securities, offering benefits such as professional management, diversification, and liquidity.

The performance and success of a mutual fund largely depend on the expertise of its asset managers. In Nigeria, the mutual fund landscape is getting more and more competitive, and various asset management companies strive to provide the best returns to their investors.

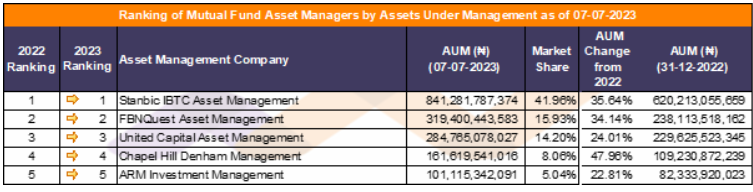

We take a closer look at the ranking of mutual fund asset managers in Nigeria based on their assets under management (AUM).

1. Stanbic IBTC Asset Management

Stanbic IBTC Asset Management claims the top spot with an impressive AUM of ₦841,281,787,374, accounting for 41.96% of the total mutual fund assets in Nigeria. Stanbic IBTC Asset Management is known for its wide range of mutual funds and investment solutions that cater to different risk appetites and financial goals.

2. FBNQuest Asset Management

Securing the second position is FBNQuest Asset Management, managing ₦319,400,443,583, which represents 15.93% of the total AUM. As a subsidiary of FBN Holdings, FBNQuest Asset Management has a strong presence in the Nigerian financial market and offers various mutual fund options to investors.

3. United Capital Asset Management

United Capital Asset Management ranks third with ₦284,765,078,027 AUM, constituting 14.20% of the total mutual fund assets in Nigeria. United Capital has a reputation for providing innovative investment solutions and managing various mutual funds tailored to meet different investment objectives.

4. Chapel Hill Denham Management

Chapel Hill Denham Management secures the fourth spot with ₦161,619,541,016 AUM, accounting for 8.06% of the total mutual fund assets. Known for its strong research-driven approach, Chapel Hill Denham offers a range of mutual fund products that attract investors seeking competitive returns.

5. ARM Investment Management

In the fifth position is ARM Investment Management, managing ₦101,115,342,091, which represents 5.04% of the total AUM. ARM Investment Management is a subsidiary of Asset & Resource Management Holding Company Limited (ARM), providing various mutual fund options to suit different risk profiles.

The top five asset management companies dominate the Nigerian mutual fund market, managing a significant portion of the total assets under management. However, it’s essential to recognize the efforts of other asset managers who play crucial roles in the industry. The next cohort of asset managers in the ranking are:

6. AXA Mansard Investments – ₦46,193,062,240 (2.30%)

7. Guaranty Trust Fund Managers – ₦44,995,683,550 (2.24%)

8. Quantum Zenith Asset Management & Investment – ₦32,653,188,238 (1.63%)

9. FSDH Asset Management – ₦21,677,262,725 (1.08%)

10. Lotus Capital – ₦20,887,793,849 (1.04%)

And the full ranking table of all mutual fund asset managers is as follows:

The Nigerian mutual fund industry continues to evolve, providing investors with a wide range of options to grow their wealth. As with any investment, investors should conduct thorough research and consider their risk tolerance and financial goals before investing in mutual funds.

Note: The data provided for the ranking is based on the information available as of 7 July 2023 and is subject to change with new developments in the mutual fund market.

Investors are advised to check for updated information before making any investment decisions.

News24 hours ago

News24 hours agoNIGERIAN BREWERIES PARTNERS OZA CARNIVAL

Top Stories11 hours ago

Top Stories11 hours agoTinubu’s Aide Condemns Plan To Reinstall ‘Jesus Is Not God’ Banner In Lekki Mosque

Top Stories6 hours ago

Top Stories6 hours agoBreaking: FIRS Announces Fresh Recruitment, See Eligibility Criteria, Application Deadline

News12 hours ago

News12 hours agoPetrol To Sell ₦935/Litre From Today – IPMAN

Top Stories12 hours ago

Top Stories12 hours ago2025 Budget Cannot Address Nigeria’s Economic Challenges – Atiku

Top Stories9 hours ago

Top Stories9 hours agoPrimate Ayodele’s Prophecies For 2025

Entertainment11 hours ago

Entertainment11 hours agoI will be more influential in Nigeria than UK – Tobi Adegboyega

News11 hours ago

News11 hours agoPresident Tinubu’s reforms not responsible for food stampedes – FG