Top Stories

Breaking: Currency in circulation declines for first time in 5 months

Nigeria’s currency in circulation recorded a decline in July 2023, according to the latest data from the Central Bank of Nigeria (CBN)

The data showed that the currency in circulation dropped to N2.59 trillion in July 2023 from N2.6 trillion in June 2023, marking the first monthly decrease since February 2023 when it plunged to N982 billion following the naira swap crisis.

Currency outside banks also fell slightly from N2.26 trillion in June to N2.20 trillion in the month under review.

The currency in circulation, which measures the amount of cash and coins outside the banking system, was at its peak in July 2022 when it reached N3.2 trillion. However, since then, it has been on a downward trend as Nigeria faces high inflation and a weakening currency.

The marginal decline in currency in circulation could be attributed to several factors, such as the increased use of electronic payment channels, the reduced demand for cash, and the CBN’s efforts to mop up excess liquidity in the system.

The CBN has been implementing various policies to stabilize the naira and curb inflation, such as increasing the cash reserve ratio (CRR) of banks, conducting open market operations (OMO), and adjusting the exchange rate regime.

However, these measures have not been enough to stem the tide of naira depreciation and inflationary pressures.

The naira has lost over 40% of its value against the US dollar in the past year, trading at around N870 per dollar in the parallel market as of August 2023. The official exchange rate, which is used by exporters and investors closed around N761/$1.

Meanwhile, inflation has remained above the CBN’s target single-digit range, hitting 24.08% in July 2023. The high inflation rate has eroded the purchasing power of Nigerians and increased the cost of living.

The CBN has reiterated its commitment to achieving price stability and exchange rate stability, but analysts have expressed doubts about its ability to do so given the structural and fiscal challenges facing the economy.

Some have called for more coordination between the monetary and fiscal authorities to address the underlying issues of low productivity, weak revenue generation, and rising debt levels.

Top Stories1 hour ago

Top Stories1 hour agoBreaking: Ibadan Stampede: Court Orders Remand Of Ooni’s Ex-Wife, School Principal

Top Stories7 hours ago

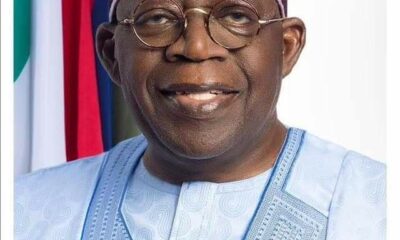

Top Stories7 hours agoI’m not prepared to downsize my cabinet — Tinubu

News7 hours ago

News7 hours agoBREAKING: “I Have No Regrets” – Tinubu Defends Fuel Subsidy Removal Amid Economic Hardship [VIDEO]

Entertainment4 hours ago

Entertainment4 hours agoJay-Z has no ‘plans to show loyalty to longtime friend Diddy’ as he battles r@pe allegation

Sports3 hours ago

Sports3 hours agoGOAT: Who said Messi is better than me – Cristiano Ronaldo

Entertainment3 hours ago

Entertainment3 hours agoRegina Daniels reveals the best way to predict one’s future as she shares more photos from her vacation

Politics6 hours ago

Politics6 hours agoI will not downsize my cabinet — Tinubu vows

Breaking News6 hours ago

Breaking News6 hours agoNaira appreciates massively against dollar ahead Christmas holidays