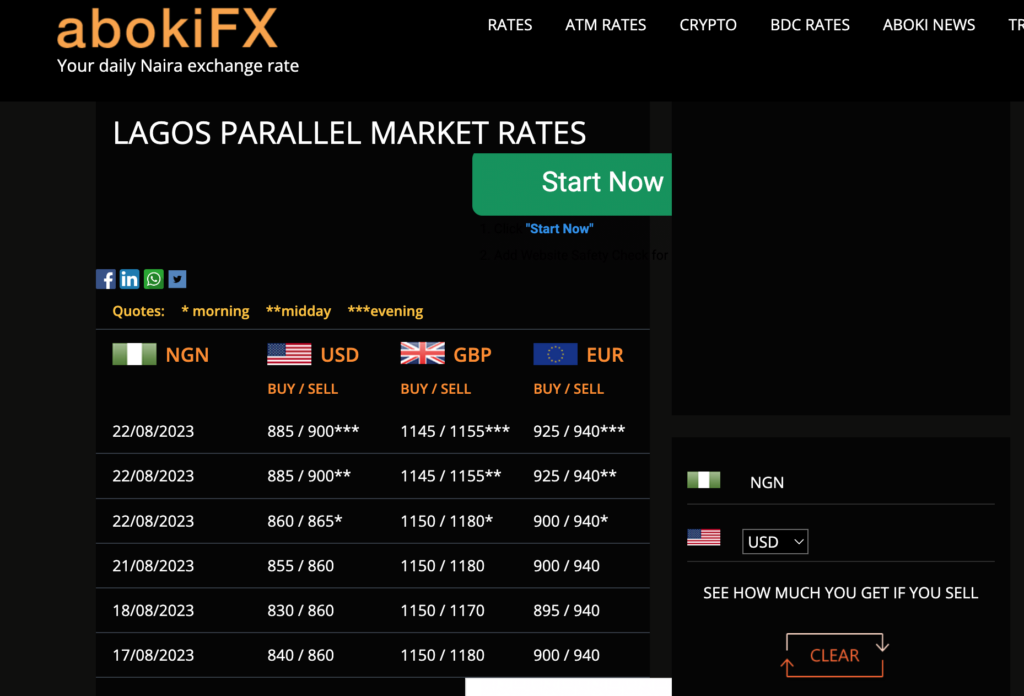

The exchange rate between the naira and the dollar plummeted to N900/$1 on the black market, based on quotes received by Nairametrics late on Tuesday.

This represents a stark depreciation from N840/$1 where it traded late last week, subsequent to the central bank’s warning to speculators about a potential decline.

The rates traded for around N865-N870/$1 earlier on Tuesday but the decline later in the evening suggests rapid demand is on the rise as supply challenges persist.

In mid-August, the dollar was quoted as low as N955/$1, stoking fears among investors that the exchange rate might plummet to N1000/$1.

The Tinubu administration, however, indicated its resolve to tackle the rapid depreciation of the exchange rate, bolstered by the central bank’s commitment to intervene.

Furthermore, the government publicized that the NNPC had secured a deal to borrow $3.5 billion, funds earmarked to boost supply amidst escalating demand pressures. Such measures buoyed the local currency, hinting that the black market premium over the official I&E Window might shrink to a mere 5%, a scenario welcomed by the market.

Yet, recent insights from JP Morgan revealed that as of December 2022, Nigeria’s central bank possessed net reserves amounting to approximately $3.7 billion. This disclosure rattled analysts, and the exact cause behind the naira’s depreciation remains nebulous.

Operators, speaking to Nairametrics under the condition of anonymity, suggested that the currency’s slide can be attributed to mounting demand pressures.

One such operator, choosing to be identified simply as “Musa”, speculated that the currency’s brief appreciation earlier in the week was triggered by speculator anxieties over potential appreciation. However, Musa emphasized that genuine demand persists, and it remains unfulfilled due to unresolved supply issues.

“We have heard so much from the government but we are yet to see the dollar. Maybe when it starts to flow the exchange rate will be stronger” Musa stated.

Adding another layer, Nigeria’s central bank declared its intentions to reincorporate BDC operators into the forex market, guided by a revamped set of protocols. This maneuver was heralded by many analysts who conversed with Nairametrics as a judicious stride towards ameliorating liquidity at the retail level.

In related news, trading on the official I&E window on August 22 witnessed the exchange rate between the naira and the dollar settling at N770/$1, a drop from N761.32 the previous day. The intra-day high soared to N799.9/$1, whereas the intra-day low dipped to N720/$1. Market activity for the day registered a turnover of $122 million.

Currency tracking platform AbokiFX also captured the exchange rate trades at N900/$1 on Tuesday.

The Federal Inland Revenue Service (FIRS) has begun its recruitment exercise for experienced professionals to…

Primate Elijah Ayodele Unveils 94-Page Prophecy for 2025, Makes Striking Predictions About Nigeria’s Political and…

The Senior Special Assistant to President Bola Tinubu on Community Engagement (North Central), Abiodun Essiet,…

The Minister of Information and National Orientation, Mohammed Idris, has warned politicians against linking stampedes…

Tobi Adegboyega, founder of the Salvation Proclaimers Anointed Church (SPAC Nation), has stated that he…

The Independent Petroleum Marketers Association of Nigeria has said that petrol is going to sell…