Top Stories

Bank customers in last-minute rush as NIN-BVN linkage deadline expires tomorrow

Banks are currently experiencing a surge of customers as the March 1 deadline for the linkage of Nigeria National Identification Numbers (NIN) to Bank Verification Numbers (BVN) approaches.

This development follows a circular issued by the Central Bank of Nigeria (CBN) in 2023, mandating existing customers to complete the full profiling of accounts established through agents within the Nigeria Inter-Bank Settlement System.

The circular stipulated that all funded accounts or wallets must be placed on “Post No Debit or Credit” status, with no further transactions permitted until compliance is achieved.

Banks are currently experiencing a surge of customers as the March 1 deadline for the linkage of Nigeria National Identification Numbers (NIN) to Bank Verification Numbers (BVN) approaches.

This development follows a circular issued by the Central Bank of Nigeria (CBN) in 2023, mandating existing customers to complete the full profiling of accounts established through agents within the Nigeria Inter-Bank Settlement System.

The circular stipulated that all funded accounts or wallets must be placed on “Post No Debit or Credit” status, with no further transactions permitted until compliance is achieved.

It also required the electronic revalidation of BVN or NIN associated with all accounts and wallets by January 31, 2024.

This amendment to Section 1.5.3 of the Regulatory Framework for Bank Verification Number (BVN) Operations and Watch List for the Nigerian Banking Industry (The Guidelines) mandated accounts to be tagged with valid and correct BVN and/or NIN.

Consequently, unfunded accounts or wallets would be immediately subjected to a “Post no debit or credit” status until the necessary linkage processes were successfully completed.

This term indicates restrictions imposed by banks on specific accounts, disallowing customers from making withdrawals, transfers, or debits from their accounts.

As the deadline approaches, there has been a notable increase in customer traffic within banking halls as individuals endeavor to link their BVNs and NINs to their bank accounts.

Visits by a reporter to various banks in Abuja revealed crowded banking halls as customers sought to avoid potential restrictions on their accounts in the final 48 hours before the deadline.

Some customers expressed frustration at the challenges faced during the linkage process, citing poor network connectivity within the banks.

“I have been here since 8 am, and they have not been able to link my NIN to my BVN. The network is slow, and there are numerous people in the queue for the same reason,” one customer, who simply gave his name as Fred lamented.

Observations at branches of several commercial banks in Abuja City Centre, depicted substantial queues, with customers lining up to complete the necessary NIN-BVN linkage for their bank accounts.

Top Stories16 hours ago

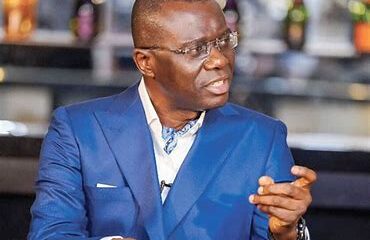

Top Stories16 hours ago#ENDSARS GAFFE: GOVERNOR SANWO-OLU SUSPENDS AIDE

Top Stories16 hours ago

Top Stories16 hours ago2027: Residents Push For Ambode’s Return As Lagos Governor

News16 hours ago

News16 hours agoMore Borrowing Needed Despite Improved Revenue By Agencies – Edun

Entertainment14 hours ago

Entertainment14 hours agoBishop TD Jakes Sues Fellow Pastor For Defamation Following Sex Abuse Allegations

Entertainment5 hours ago

Entertainment5 hours agoDayo Amusa Finally Opens Up On The Father Of Her Adorable Child(PHOTO)

Entertainment14 hours ago

Entertainment14 hours agoYou didn’t think of your father’s business, Patrick Doyle slams Davido

Entertainment5 hours ago

Entertainment5 hours agoSee Beautiful Photos Of Dayo Amusa And Son

Entertainment5 hours ago

Entertainment5 hours agoMiley Cyrus denies plagiarizing Bruno Mars song