President Biden can once again brag about an economy creating way more jobs than economists think it should be able to. It could end up being too much of a good thing.

Employment data for March showed the economy added 303,000 new jobs, about 50% more than economists were forecasting. That’s unqualified good news. Fears of an economic slowdown and possible recession continue to prove unfounded.

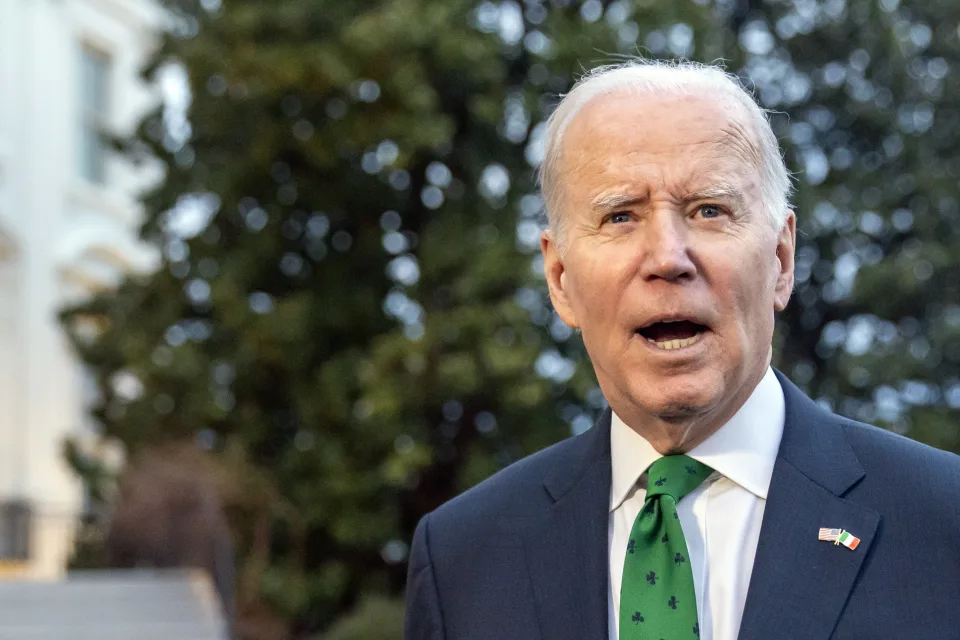

Biden continually talks up the job market, but the strongest job growth of any president in US history doesn’t seem to be doing him any good.

Biden’s approval rating has been stuck at around 40% for the last year, showing virtually no improvement during a time in which the US economy has created 6.4 million jobs.

Rather, it seems Biden would need something else to make voters feel like the economy is getting better. The most obvious would be inflation coming down or reversing. But as we noted earlier this week, gas prices are creeping higher and the administration is making moves to head this off.

Another big help for Biden would be Federal Reserve interest rate cuts that begin to reduce the cost of buying a home, or car, or anything else purchased with a loan. But it’s now looking like the strong job market itself could prevent the Fed from lowering rates in time to help Biden in November.

“The data are simply far too hot for the Fed,” economist David Rosenberg of Rosenberg Research wrote in an April 5 analysis of the job numbers. “These numbers will embolden the Fed hawks.”

That means the case for standing firm, rather than cutting rates, is getting stronger.

“The strength of the labor market and lingering worries about inflation among Federal Reserve officials have led us to push the timing of the first rate cut from the May to June meeting of the Federal Open Market Committee,” added Ryan Sweet, Chief US Economist at Oxford Economics, in an April 5 report.

Drop Rick Newman a note, follow him on Twitter, or sign up for his newsletter.

At the start of the year, the CME Group’s “Fedwatch” tool was forecasting a 98% likelihood that the Fed would have cut rates by June of this year. After Friday’s jobs report, the odds are just 53%.

And the longer the Fed waits, the more challenging the looming presidential election will be for the central bank.

In a speech this week, Fed Chair Jerome Powell reiterated that the Fed remains apolitical.

“Fed policymakers serve long terms that are not synchronized with election cycles,” Powell said. “Our decisions are not subject to reversal by other parts of the government, other than through legislation … Such independence for a federal agency is and should be rare. In the case of the Fed, independence is essential to our ability to serve the public.”

Yet the Fed may also find itself reluctant to do anything as Election Day approaches.

Should the Fed elect to hold rates steady in June, it would have just two policy meetings before Election Day to begin rate cuts. The Fed is also set to announce a policy decision on Nov. 8, the day after the election.

Rate cuts may help Biden and would certainly rankle his challenger, former President Donald Trump, who has had no problem over the years criticizing the Fed when he doesn’t like its actions. He has even attacked Powell directly, even though Trump nominated him for the role in the first place.

Biden could certainly have worse problems than a central bank not quite ready to loosen monetary policy. The Fed is holding tight for good reasons — namely, a solid economy that doesn’t seem to be tipping toward recession or in need of any special help at the moment. A far better scenario for an incumbent president than rising unemployment or other problems that might force the Fed into emergency mode.

But Biden may need more than a steady-state economy and the gradual decline of inflation, which has been his biggest economic vulnerability. Voters seem to be saying this is not enough if you believe Biden’s weak approval rating and Trump’s lead in a variety of polls.

And the window is closing for something new that might make voters more upbeat.

PRESS STATEMENT Nigerian Breweries PLC - The pioneer and largest brewing company in Nigeria which is…

Paris Saint-Germain star Achraf Hakimi has spoken out following his defeat by Ademola Lookman for…

Ukrainian boxer Oleksandr Usyk reinforced his position as one of the greatest heavyweight champions in…

The National Emergency Management Agency (NEMA) has said it has put all its zonal, territorial…

Erhiatake Ibori-Suenu, member representing Ethiope Federal Constituency of Delta State in the House of Representatives…

The Economic and Financial Crimes Commission (EFCC) has reportedly secured a final forfeiture order for…