Top Stories

FG Speaks On Spending N20T Pension Fund For Infrastructure Development

The Federal Government on Thursday denied an allegation that it intended to borrow the N20tn pension fund for infrastructure development.

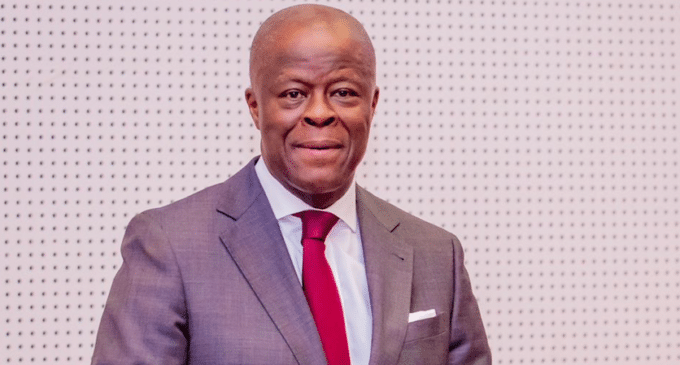

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, in a statement in Abuja, said the government would comply with the established rules and regulations governing the pension fund.

The minister was reported to have told journalists, after a two-day Federal Executive Council meeting at the Presidential Villa on Tuesday, that the government would unveil a plan to harness local funds, including the fund, to finance infrastructure development.

However, in a statement in Abuja on Thursday, Edun noted that the pension industry, similar to other sectors in the financial industry, is strictly regulated by specific legal frameworks.

He said the Federal Government did not plan to exceed these legal boundaries, emphasising that the government was committed to protecting workers’ pensions.

“It has come to my notice that stories are making the round that the Federal Government plans to illegally access the hard-earned savings and pension contributions of workers. Nothing could be farther from the truth.

Highly regulated

“The pension industry, like most the financial industries, is highly regulated. There are rules. There are limitations about what pension money can be invested in and what it cannot be invested in.

“The Federal Government has no intention whatsoever to go beyond those limitations and go outside those bounds which are there to safeguard the pensions of workers.

“What was announced to the Federal Executive Council was that there was an ongoing initiative drawing in all the major stakeholders in the long-term saving industry, those that handle funds that are available over a long period to see how, within the regulations and the laws; these funds could be used maximally to drive investment in key growth areas,” Edun clarified.

Furthermore, Edun clarified that the government had no intention of increasing the risk associated with the pension funds or allowing their investments to become less secure.

Earlier on Thursday, the Nigeria Labour Congress and the Trade Union Congress of Nigeria asked the Federal Government to refrain from tampering with the pension fund.

The NLC President, Joe Ajaero and the TUC Deputy President, Tommy Okon, in a joint statement on Thursday, advised the government not to risk the future of workers by borrowing the money to fund infrastructure development.

They stated, “Nigerian workers have entrusted their hard-earned savings for retirement security, not as a means for government projects. It is imperative to halt any further plans to tap into these funds, especially given the lack of transparency and accountability in past government borrowing practices.’’

The unions demanded assurances from the government that workers retirement funds [b]“would not fall victim to further Federal Government borrowing, especially when the PENCOM Board has not been constituted as envisaged by the statutes,’’ [/b]arguing further that any plan to borrow the funds is not backed by the Pension Act.

Labour expressed regrets that despite the government’s assurances of widespread consultation with major stakeholders in the pension industry, the NLC and TUC, representing the owners of the entire pension fund contributions, had neither been consulted nor informed about the government’s intentions.

According to the unions, the lack of transparency undermined the sanctity of pension funds, which it said should always be treated with the utmost reverence and protection.

Similarly, the Head of Information, Nigerian Union of Pensioners, Bunmi Ogunkolade, urged the government to find an alternative source to fund its infrastructure development plan, noting that the pension fund did not belong to pensioners but to workers.

He said, “Simply put, we are not in support. We have told the government to go and look for where to get their money. We have appealed to them that they should please look for where to get money to fund infrastructure or whatever.

On its part, the Nigeria Union of Pension in Kaduna State also advised the Federal Government against using the money for infrastructure development.

The state Secretary of the Nigeria Union of Pensioners, Mallam Alhassan Balarabe Musa, who stated this in an interview with The PUNCH, said, “The Federal Government under former President Muhammadu Buhari attempted a similar thing but failed.’’

“For us we are not happy about that. As of now, our national headquarters are trying everything to ensure that the fund is not going to be accessible.

“Now, we have so many retirees under contributory pension who are unable to get their gratuities. So, why will the Federal Government take that kind of amount? I think it’s going to be unfortunate and unacceptable.”

The NUP Pensioners, Ogun State Council, gave a similar warning.

The Secretary of the union, Dr Bola Lawal, said “I am sure if you have the opportunity to ask every pensioner none will accept this move of the government. Where is the assurance that this money will be paid back on time?

Osun pensioners

When contacted, the Coordinator, Osun State Contributory Pensioners, Mr Toyin Ayinde, warned the government against tampering with the contributions of retirees.

He said, “The government must not touch our money. What exactly is the matter with them? We don’t want anyone to touch our money under any guise. We are not interested in any proposal from them.”

News23 hours ago

News23 hours agoNIGERIAN BREWERIES PARTNERS OZA CARNIVAL

Top Stories11 hours ago

Top Stories11 hours agoTinubu’s Aide Condemns Plan To Reinstall ‘Jesus Is Not God’ Banner In Lekki Mosque

Top Stories6 hours ago

Top Stories6 hours agoBreaking: FIRS Announces Fresh Recruitment, See Eligibility Criteria, Application Deadline

News11 hours ago

News11 hours agoPetrol To Sell ₦935/Litre From Today – IPMAN

Top Stories11 hours ago

Top Stories11 hours ago2025 Budget Cannot Address Nigeria’s Economic Challenges – Atiku

Entertainment11 hours ago

Entertainment11 hours agoI will be more influential in Nigeria than UK – Tobi Adegboyega

News11 hours ago

News11 hours agoPresident Tinubu’s reforms not responsible for food stampedes – FG

Top Stories8 hours ago

Top Stories8 hours agoPrimate Ayodele’s Prophecies For 2025