Top Stories

Stock market today: Stocks pull back from records after Dow touches 40,000 for first time

US stocks could not reach new records on Thursday, despite the Dow Jones Industrial Average (^DJI) touching 40,000 for the first time ever.

The Dow finished the day down 0.1%, closing at 39,869 after briefly surpassing its new price milestone earlier in the session. The tech-heavy Nasdaq Composite (^IXIC) fell about 0.3%, while the S&P 500 (^GSPC) dropped around 0.2%. The S&P closed just below 5,300 after eclipsing that number for the first time on Wednesday.

Earlier on Thursday, three Fed officials — Cleveland Fed President Loretta Mester, New York Fed President John Williams and Richmond Fed President Thomas Barkin — warned of higher-for-longer interest rates while speaking at separate events. That commentary appeared to take the wind out of stocks’ recent rally.

“Holding our restrictive stance for longer is prudent at this point as we gain clarity about the path of inflation,” Mester said at an event in Wooster, Ohio.

Stocks rallied on Wednesday after new data showed signs of cooling inflation, which spurred bets on a Federal Reserve rate cut in September. All three major indexes closed at record highs as a result.

Investors also jumped into bonds, sending the 10-year Treasury yield (^TNX) down near one-month lows at around 4.33%. On Thursday, yields ticked about 2 basis points higher with the 10-year trading around 4.38%.

On the corporate front, Walmart (WMT) posted quarterly profits, revenue, and same-store sales that beat Wall Street estimates. Shares of the US retail giant finished the day up more than 7%.

Meanwhile, a mystery was solved as Warren Buffett’s Berkshire Hathaway (BKR-B) revealed it has taken a $6.7 billion stake in Chubb (CB). The disclosure ended months of suspense over a position kept concealed in regulatory filings. The insurer’s shares closed about 5% higher on Thursday.

Top Stories1 hour ago

Top Stories1 hour agoBreaking: Ibadan Stampede: Court Orders Remand Of Ooni’s Ex-Wife, School Principal

Top Stories7 hours ago

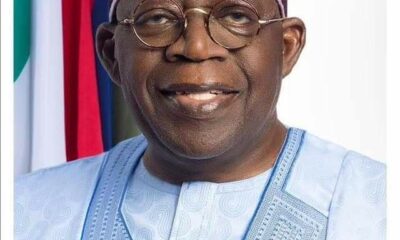

Top Stories7 hours agoI’m not prepared to downsize my cabinet — Tinubu

News7 hours ago

News7 hours agoBREAKING: “I Have No Regrets” – Tinubu Defends Fuel Subsidy Removal Amid Economic Hardship [VIDEO]

Entertainment3 hours ago

Entertainment3 hours agoJay-Z has no ‘plans to show loyalty to longtime friend Diddy’ as he battles r@pe allegation

Sports3 hours ago

Sports3 hours agoGOAT: Who said Messi is better than me – Cristiano Ronaldo

Entertainment3 hours ago

Entertainment3 hours agoRegina Daniels reveals the best way to predict one’s future as she shares more photos from her vacation

Politics6 hours ago

Politics6 hours agoI will not downsize my cabinet — Tinubu vows

Breaking News6 hours ago

Breaking News6 hours agoNaira appreciates massively against dollar ahead Christmas holidays