News

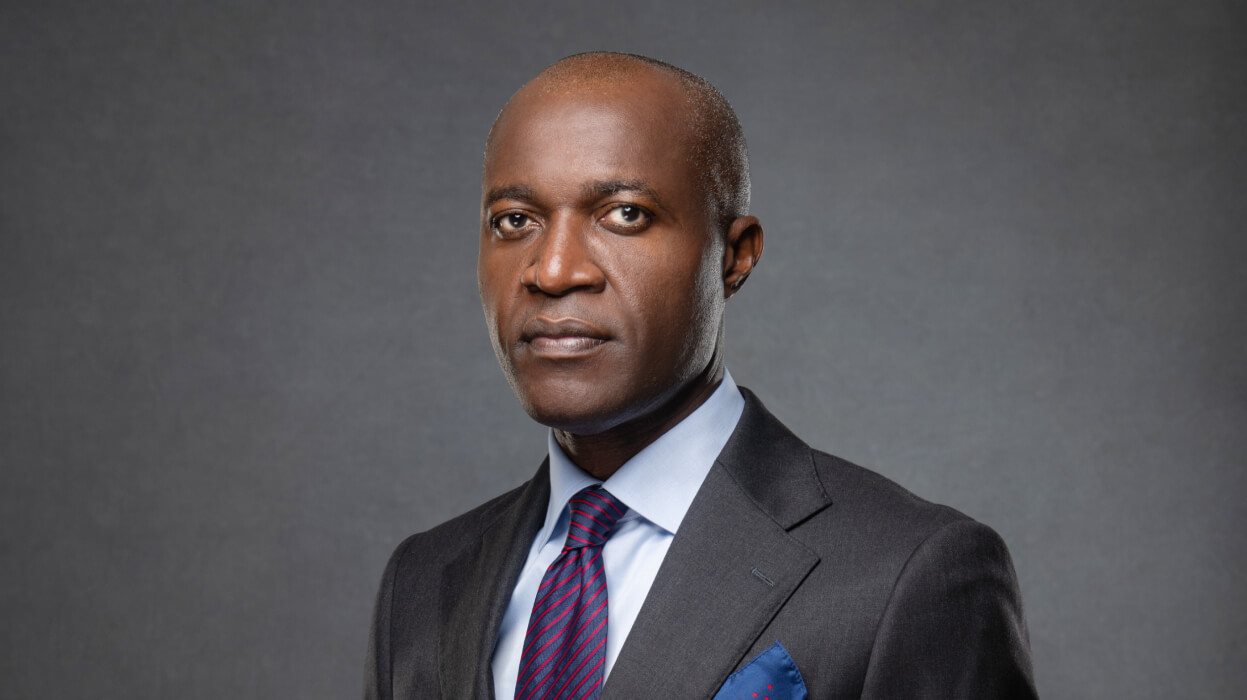

Access Bank targets top 20 status in the UK with $1 billion annual profit goal’- Ogbonna

Managing Director of Access Bank, Mr. Roosevelt Ogbonna has said that Access Bank UK, a wholly owned subsidiary of Access Bank, is well-positioned to become one of the top 20 banks in the UK, with an annual profit target of approximately $1 billion.

Ogbonna made this statement during Access Holdings Plc’s Facts Behind the Rights Issue Presentation, held recently on the Nigerian Exchange.

The group is currently undertaking a capital raising initiative of N351 billion through a rights issue to existing shareholders.

As part of this rights issue, 17.772 billion ordinary shares are being offered at N19.75 per share.

The Rights Issue is designed to strengthen the Group’s financial footing and support ongoing working capital needs, including organic growth funding for its banking and non-banking subsidiaries.

“Access Bank UK is well positioned to become one of the top 20 banks, generating a profit of about $1 billion annually,” he said.

Shareholders’ value

Ogbonna said that the bank will continue to focus on shareholders’ value, as it urged shareholders to participate actively in its ongoing N351.02 billion rights issue.

He said the bank’s presence in this sophisticated market has continued to position it strategically in the areas of facilitating and enhancing cross-border trade across the globe.

According to him, its resolve to provide innovative financial solutions has played a vital role in supporting businesses and investors involved in international trade over the years.

Consolidation phase

He noted that the bank is currently in its consolidation phase to add value to shareholders’ investment, having invested heavily in new markets, skills, and infrastructure, technology over the last 10 years.

“All our earnings are in the UK dollars. So, every time there is a devaluation, our UK business continues to grow, so we have created a natural hedge.

Going forward, our consolidation with shareholders will be to show what we have built over the years. Our international business is competing with other foreign banks in capitalisation. The institution has indeed delivered in all its commitment from 2002,” he added.

Reason for conducting a rights issue

The chairman of Access Holdings Plc, Aigboje Aig-Imoukhuede urged shareholders to participate actively in the ongoing rights Issue.

Imokhuede said the additional capital would enable it to maximise emerging opportunities and deliver long-term value to our shareholders, adding that the bank is committed to strengthening ties with shareholders and enhancing value creation.

“The reality is this: the reason we conducted a rights issue is because it would be unfortunate if, after supporting us through the highs and lows, through the times of investing, through the sweat, and tears, you missed out just as this money-making machine is about to start generating profits. Don’t make that mistake,” he said.

What the NGX said

The Group Chairman, NGX Group, Alhaji Umaru Kwairanga stated that Access Holdings in just two decades has transformed into the biggest financial services institution in Nigeria and one of the biggest in the African continent.

Chairman, of NGX, Ahonsi Unuigbe said the recent directive on recapitalization issued by the CBN aims to strengthen the financial stability and resilience of banks, saying that “in response to this directive, NGX is committed to supporting banks, including Access, in their capital-raising efforts.

“By providing a robust and efficient platform for capital formation, NGX facilitates the mobilization of resources necessary for banks to meet this regulatory requirement and sustain growth.”

News14 hours ago

News14 hours agoAppeal Court Overturns Judgment On Rivers LG Elections

News7 hours ago

News7 hours agoWhy Seyi Tinubu Can’t Be Lagos Governor- Igbokwe

Top Stories14 hours ago

Top Stories14 hours ago“I did not punch Akpabio” – Senator Bamidele speaks on alleged fight with Senate President

Top Stories14 hours ago

Top Stories14 hours ago2027: “No vacancy for non-indigenes in Alausa” – Lagos youths tell Seyi Tinubu

Top Stories10 hours ago

Top Stories10 hours agoSimon Ekpa Not Our Member, Should Not Be Associated With Us- IPOB

Politics14 hours ago

Politics14 hours ago‘Don’t Waste Your Time Again In 2027’: Bode George Begs Atiku (Video)

News14 hours ago

News14 hours agoMy husband assaulted me, ruined my career – Olajumoke Onibread

Top Stories15 hours ago

Top Stories15 hours agoNational Assembly Passes Bill For Life Imprisonment For Drug Traffickers