Top Stories

Dangote Refinery To Sell Remaining NNPC 12.7% Stake – Fitch

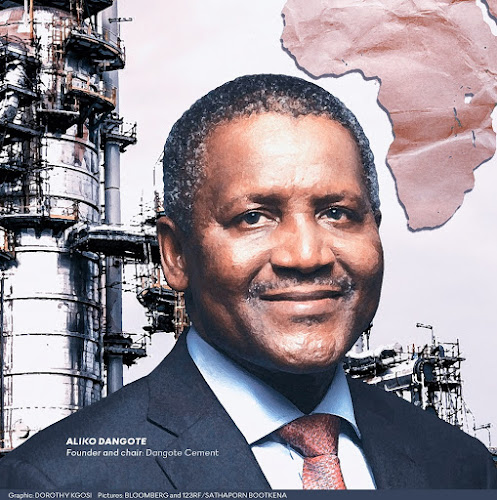

The Dangote Refinery is planning to sell a 12.7 per cent stake in 2024 for loan servicing, Fitch Ratings, a credit rating agency says in a report released on Monday.

Fitch recalled that the Nigerian National Petroleum Company Limited had earlier planned to acquire a 20 per cent stake in the refinery.

However, the rating agency indicated that the decision of the national oil firm not to exercise its option of acquiring an additional 12.75 per cent as of June 2024 may impact the group’s ability to service loans.

In 2021, the NNPC acquired a 7.25 per cent stake in the refinery for $1.0bn, with an option to purchase the remaining 12.75 per cent stake by June 2024. But the national oil firm has since reneged on its decision.

“Since the option has not been exercised, the group plans to divest a 12.75 per cent stake in DORC in 2024.

“The group intends to service its significant syndicated loan maturing in August 2024 from the equity divestment. However, timely divestment and meeting the imminent maturity are highly uncertain in our view,” Fitch said.

It could be recalled that the President of the Dangote Group, Alhaji Aliko Dangote, opened up in July that the NNPC has only a 7.2 per cent stake in the refinery and not 20 per cent as most Nigerians used to think.

“The agreement was actually 20 per cent which we had with NNPC, and they did not pay the balance of the money up till last year; then we gave them another extension up till June (2024), and they said that they would remain where they have already paid, which is 7.2 per cent. So NNPC owns only 7.2 per cent, not 20 per cent.” Dangote stated.

NNPC confirmed this, saying it decided not to invest further in the refinery.

“NNPC Limited periodically assesses its investment portfolio to ensure alignment with the company’s strategic goals.

“The decision to cap its equity participation at the paid-up sum was made and communicated to Dangote Refinery several months ago,” the NNPC said in a statement by its spokesperson, Olufemi Soneye.

Meanwhile, a former Minister of Education, Oby Ezekwesili, called for an independent audit of why the Nigerian National Petroleum Company Limited capped its investment in the Dangote Petroleum Refinery at 7.2 per cent instead of the planned 20 per cent.

“Did the Nigerian government not tell us it borrowed $3.3bn from Afriexim-Bank to take a stake in the Dangote refinery?” Ezekwesili asked, calling on President Bola Tinubu to immediately launch an independent audit of the Dangote refinery-NNPC transaction to offer the public the true state of play.

News24 hours ago

News24 hours agoNIGERIAN BREWERIES PARTNERS OZA CARNIVAL

Top Stories11 hours ago

Top Stories11 hours agoTinubu’s Aide Condemns Plan To Reinstall ‘Jesus Is Not God’ Banner In Lekki Mosque

Top Stories6 hours ago

Top Stories6 hours agoBreaking: FIRS Announces Fresh Recruitment, See Eligibility Criteria, Application Deadline

News12 hours ago

News12 hours agoPetrol To Sell ₦935/Litre From Today – IPMAN

Top Stories12 hours ago

Top Stories12 hours ago2025 Budget Cannot Address Nigeria’s Economic Challenges – Atiku

Top Stories9 hours ago

Top Stories9 hours agoPrimate Ayodele’s Prophecies For 2025

Entertainment12 hours ago

Entertainment12 hours agoI will be more influential in Nigeria than UK – Tobi Adegboyega

News12 hours ago

News12 hours agoPresident Tinubu’s reforms not responsible for food stampedes – FG