Business and Brands

Naira among worst performing currencies – World Bank

The naira has been listed among the worst-performing currencies in Sub-Saharan Africa in 2024

This is according to the latest edition of Africa’s Pulse, a new report by the World Bank.

As of the end of August 2024, the naira had depreciated by approximately 43 per cent year-to-date, making it one of the region’s weakest currencies alongside the Ethiopian birr and South Sudanese pound.

The depreciation of the naira is attributed to several factors, including surging demand for United States dollars in the parallel market, limited dollar inflows, and delays in foreign exchange disbursements by Nigeria’s central bank.

The World Bank’s report further highlights that demand for dollars, driven by financial institutions, non-financial end-users, and money managers, has exacerbated the pressure on the naira.

It noted, “By August 2024, the Ethiopian birr, Nigerian naira, and South Sudanese pound were among the worst performers in the region. The Nigerian naira continued losing value, with a year-to-date depreciation of about 43 per cent as of end-August.

“Surges in demand for US dollars in the parallel market, driven by financial institutions, money managers, and non-financial end-users, combined with limited dollar inflows and slow foreign exchange disbursements to currency exchange bureaus by the central bank explain the weakening of the naira.”

This situation has persisted despite some foreign exchange market reforms introduced by the Nigerian government, including the liberalization of the official exchange rate that began in June 2023.

However, these efforts have so far been insufficient to stabilize the currency.

The naira’s struggle reflects broader economic challenges in Nigeria, including limited foreign currency reserves and ongoing inflationary pressures.

Top Stories20 hours ago

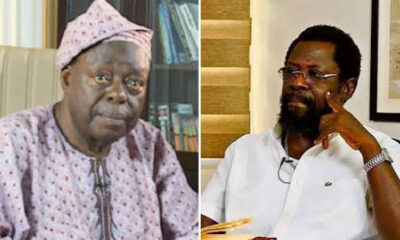

Top Stories20 hours agoDele Farotimi Speaks on Lying Against Afe Babalola After Gaining Freedom

Politics20 hours ago

Politics20 hours agoPDP Picks Holes In President Tinubu’s Media Chat

Top Stories20 hours ago

Top Stories20 hours agoCourt Orders DSS To Release Miyetti Allah President Pending Trial

News20 hours ago

News20 hours ago100+ Merry Christmas Wishes and Prayers to Send to Family & Friends on Xmas 2024

Entertainment19 hours ago

Entertainment19 hours agoSeyi Edun wins hearts as she makes peace with Toyin Abraham, shows support for her new movie; Toyin reacts (Video)

Entertainment19 hours ago

Entertainment19 hours agoProphet Odumeje issues warning to those discrediting his miracles

Top Stories13 hours ago

Top Stories13 hours agoBREAKING: FG ‘Drags Zinox CEO Leo Stan Ekeh, Wife, Others Over Alleged N162M Contract Fraud Case Against FIRS’

Sports13 hours ago

Sports13 hours agoEngland-Born Ademola Lookman Credits Nigeria Switch For Success