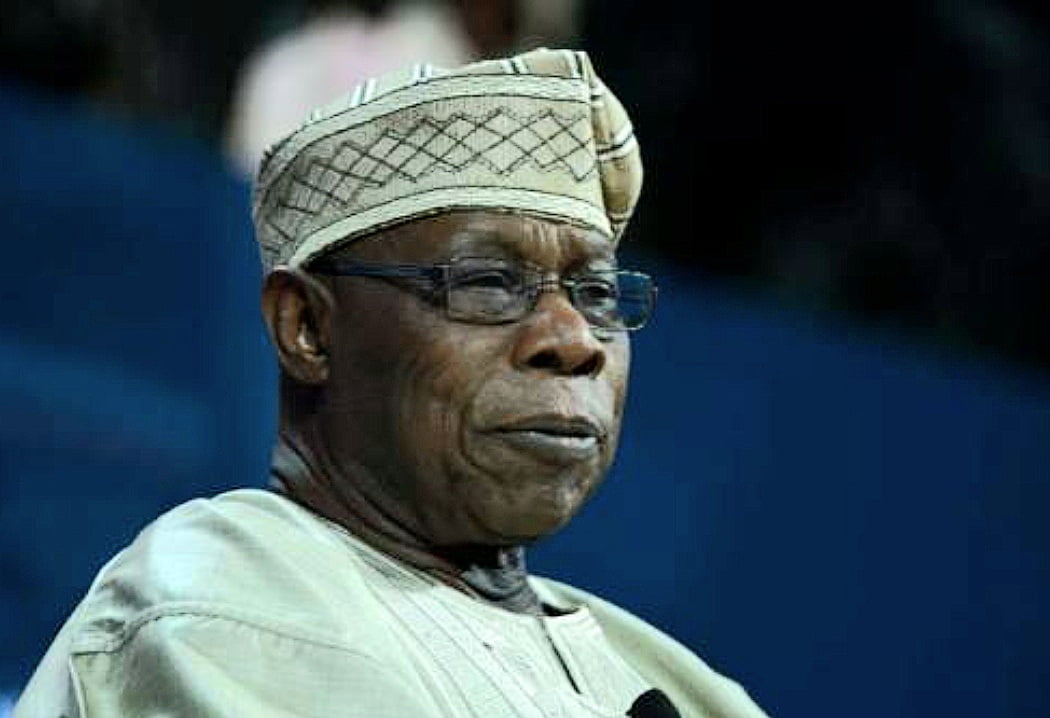

Former Nigerian President Olusegun Obasanjo has recounted how he boosted the country’s foreign reserves from a meager $3.7 billion to $45 billion during his eight-year tenure.

Speaking in an interview with News Central, which aired on Thursday, Obasanjo disclosed that he inherited a heavy debt burden upon assuming office.

At the time, Nigeria owed $36 billion, with debt servicing costs amounting to $3.7 billion, while the foreign reserves stood at just $3.7 billion.

The former president explained that through persistent advocacy for debt relief from international creditors, the country’s debt dropped from $36 billion to $3.5 billion by the end of his administration.

Simultaneously, the nation’s reserves grew from $3.7 billion to $45 billion during the same period.

“When I came in 1999, I met $3.7 billion in reserve. And as I told you, we were spending $3.5 billion to service debt. That’s how we had. By the time I left eight years later, with debt relief.

“When I came in, we had a debt overhang of close to $36 billion. By the time I left, with the debt relief and clearing what we had to clear, the quantum of debt that I left was about $3.5 to $3.6 billion from over $3.6 billion or around $36 billion. At the same time, the reserve that was $3.7 billion went to $45 billion,” Obasanjo said.

Furthermore, the former president stated that he established the Excess Crude Account (ECA) to manage budget surpluses from crude oil sales, leaving a total of $25 billion in the account.

He explained that the budget during his administration was intentionally conservative, allowing them to save the surplus in the ECA.

“At the same time, we had what we called excess crude- this is the amount between what we budgeted that we would sell the crude oil and what we actually sell it, normally we are conservative in the budget- we had around $25 billion. When you add that to reserve, we are talking of $70 billion,” Obasanjo said.

Obasanjo further lamented that the savings accumulated in the treasury were depleted after he left office.

He noted that 17 years later, from 2007 to 2024, Nigeria now owes more in international debt than it did in 1999 when his administration sought debt relief.

According to him, this situation is the result of fiscal mismanagement and a lack of accountability in leadership and public service.

“The point is that I left in 2007 and today in 2024, just 17 years after, all that amount of money has gone. Not only that, but all the money they made during that period had gone.

“Today, we owe more than we owed when I came to government in 1999. Why? Poor leadership, poor management of the economy, corruption galore, and abrasive corruption which is also part of poor leadership.

“Not given consequences; that when you do something wrong, you have consequences. I call it lack of consequences and impunity,” Obasanjo added.

In recent years, Nigeria has grappled with a severe fiscal crisis driven by poor economic management, a soaring debt profile, and rising debt servicing costs.

PRESS STATEMENT Nigerian Breweries PLC - The pioneer and largest brewing company in Nigeria which is…

Paris Saint-Germain star Achraf Hakimi has spoken out following his defeat by Ademola Lookman for…

Ukrainian boxer Oleksandr Usyk reinforced his position as one of the greatest heavyweight champions in…

The National Emergency Management Agency (NEMA) has said it has put all its zonal, territorial…

Erhiatake Ibori-Suenu, member representing Ethiope Federal Constituency of Delta State in the House of Representatives…

The Economic and Financial Crimes Commission (EFCC) has reportedly secured a final forfeiture order for…