Business and Brands

Naira strengthens at NAFEX window as bitcoin slumps to $52k

The Naira gained against the US Dollar on Wednesday to close at N408.75/$1 at the I&E window.

Wednesday, 24th March 2021, the exchange rate between the naira and the US Dollar closed at N408.75/$1 at the Investors and Exporters window.

Naira gained against the US Dollar again on Wednesday to close at N408.75 to a dollar, representing a 0.26% gain compared to N409.8/$1 recorded on Tuesday.

However, in the parallel market, the naira remained relatively stable, as it closed at N486/$1, which is the same as recorded in the previous trading session.

Forex turnover increased marginally to $34.76 million, while Nigeria’s external reserve recorded the third consecutive increase, gaining $182.3 million in three days.

Trading at the official NAFEX window

Naira appreciated against the US Dollar at the Investors and Exporters window on Wednesday to close at N408.75/$1. This represents a N1.05k gain when compared to N409.8/$1 recorded on Tuesday, 23rd March 2021.

- The opening indicative rate closed at N408.98 to a dollar on Wednesday. This represents an 80 kobo gain when compared to N409.78/$1 recorded on Tuesday.

- Also, an exchange rate of N414 to a dollar was the highest rate recorded during intra-day trading before it closed at N408.75/$1. This represents the highest rate recorded in almost two weeks.

- It also sold for as low as N394/$1 during intra-day trading. A difference of N1 compared to N393 recorded in the previous day

- Forex turnover at the Investor and Exporters (I&E) window increased marginally by 5% on Wednesday, 24th March 2021.

- A cursory look at the data tracked by Nairametrics from FMDQ showed that forex turnover increased from $33.11 million recorded on Tuesday, March 23, 2021, to $34.76 million on Wednesday.

Cryptocurrency watch

Bitcoin, the most priced and popular cryptocurrency in the world slumped by over 4.06% to trade at $52,153.23 on Wednesday.

- The highly coveted digital currency lost about $2,208.34 in value, representing a decline of 4.06% in a single day.

- Ethereum also dipped by 5.75% on Wednesday to trade at $1,574.2 as of 11:52 pm on Wednesday.

- This came on the back of Jerome Powell’s comment on the risk attached to investing in bitcoins and other digital assets.

- Jerome Powell, who is the Chairman of US Federal Reserve had said the volatility of the crypto coins undermines their ability to store value, which is a basic function of money. He went further to state that bitcoin is not really useful as a store of value.

- Meanwhile, JMP Securities has predicted that “$1.5 trillion of incremental capital” could flow into bitcoin, an amount greater than the cryptocurrency’s current market cap.

- The firm sees more wealth management companies following Morgan Stanley’s example to offer bitcoin to their clients. “Around $30 trillion of assets in the U.S. retail wealth management industry currently do not have direct access to bitcoin

Brent Crude makes a rebound

Brent Crude oil gained $3.62 in Wednesday trade to close at $64.41 per barrel, representing a 5.95% gain in a single day after enduring a massive decline in the previous day.

- Oil prices had dropped as investors’ sentiments towards the resurgence of the covid pandemic increase and major European countries effect new lockdowns and others extend their lockdown.

- It is worth noting that Bonny Light gained 2.67% to close at $62.58 per barrel while WTI dipped 0.88%

- WTI closed at $60.64 (-0.88%), Brent Crude ($64.41), Bonny Light ($62.58), OPEC Basket ($62.27), and Natural gas ($2.497).

- Meanwhile, analysts believe that the OPEC+ will likely decide to keep oil production steady for another month.

External reserve gains $182.3 million three days

Nigeria’s external reserve increased by 0.08% on Tuesday, 23rd March 2021 to stand at $34.6 billion.

- This represents the third consecutive increase in three days, gaining a total of $182.27 million from $34.42 billion recorded as of March 18, 2021 to $34.6 billion as of 23rd March 2021.

- Nigeria’s reserve had lost $957.26 million year-to-date before recording increases in the past three days, which could be attributed to the recent gain in the global crude oil market.

- Nigeria will hope to continue in this trajectory, as the increase in foreign reserves indicates more foreign exchange to meet up with the nation’s demand.

Top Stories21 hours ago

Top Stories21 hours agoBreaking: Police Apologizes Over Reports Of DJ Switch’s Arrest

News20 hours ago

News20 hours agoHeritage Bank In Crisis…Shut Down Over Mass Sack, Undue Process

Politics4 hours ago

Politics4 hours agoIsraeli Missiles Hit Iran, Iraq And Syria

News3 hours ago

News3 hours agoBlack Market Dollar (USD) To Naira (NGN) Exchange Rate Today 19th April 2024

Entertainment4 hours ago

Entertainment4 hours agoNollywood Eniola Ajao’s movie ‘Ajakaju’ rakes over N200 million in cinemas

Top Stories4 hours ago

Top Stories4 hours agoTinubu Deliberately Put Northerners In Key Places – Ribadu

News4 hours ago

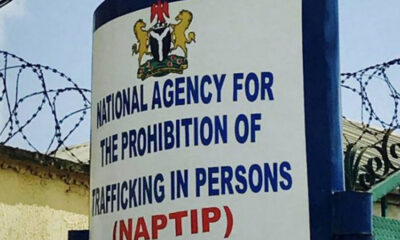

News4 hours agoNAPTIP arrests fake Reverend Sister for allegedly trafficking 38 children

News3 hours ago

News3 hours agoTop Nigerian Newspaper Headlines For Today, Friday, 19th April, 2024