Tech

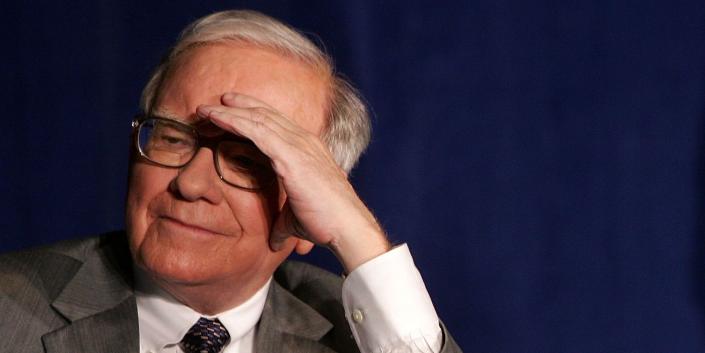

Warren Buffett dismissed bitcoin as a worthless delusion…here are his 16 best quotes about crypto

Warren Buffett has been a vocal critic of bitcoin in recent years, repeatedly dismissing the cryptocurrency as worthless and a risky, speculative asset.

Crypto fans brushed off the billionaire investor and Berkshire Hathaway CEO’s warnings, driving bitcoin’s price up from around $7,000 at the start of 2020 to over $64,000 in November 2021. However, the currency has plunged 65% to below $17,000 since the beginning of 2022.

Here are Buffett’s 16 best quotes about Bitcoin and crypto, edited and condensed for clarity:

1. “Cryptocurrencies basically have no value and they don’t produce anything. They don’t reproduce, they can’t mail you a check, they can’t do anything, and what you hope is that somebody else comes along and pays you more money for them later on, but then that person’s got the problem. In terms of value: zero.” — CNBC, February 2020

2. “It’s ingenious and blockchain is important but bitcoin has no unique value at all, it doesn’t produce anything. You can stare at it all day and no little bitcoins come our or anything like that. It’s a delusion basically.” — CNBC, February 2019

3. “If you and I buy various cryptocurrencies, they’re not going to multiply. There are not going to be a bunch of rabbits sitting there in front of us. They’re just gonna sit there. And I gotta hope next time you get more excited after I’ve bought if from you and then I’ll get more excited and buy it from you. We could sit in the house by ourselves and we could keep running up the price between us. But at the end of the time there’s one bitcoin sitting there and now we’ve gotta find somebody else. They come to an end.” — CNBC, May 2018

4. “In terms of cryptocurrencies generally, I can say almost with certainty that they will come to a bad ending. If I could buy a five-year put on every one of the cryptocurrencies, I’d be glad to do it, but I would never short a dime’s worth.” — CNBC, January 2018

5. “Probably rat poison squared.” — Fox Business interview at 2018 meeting

6. “It’s a mirage basically. It’s a very effective way of transmitting money and you can do it anonymously and all that. A check is a way of transmitting money too. Are checks worth a whole lot of money just because they can transmit money? I hope bitcoin becomes a better way of doing it but you can replicate it a bunch of different ways. The idea that it has some huge intrinsic value is just a joke in my view.” — CNBC, March 2014.

7. “It’s not a currency. It does not meet the test of a currency. I wouldn’t be surprised if it’s not around in 10 or 20 years. It is not a durable means of exchange, it’s not a store of value. It’s been a very speculative kind of Buck Rogers-type thing and people buy and sell them because they hope they go up or down just like they did with tulip bulbs a long time ago.” — CNBC, March 2014

8. “A rising price does create more buyers and people think ‘I’ve gotta get in on this’ and it’s better if they don’t understand it. If you don’t understand it you get much more excited than if you understand it.” — CNBC, May 2018

9. “It will feed on itself for a while and sometimes for a long while and sometimes to extraordinary numbers. But they come to bad endings and cryptocurrencies will come to bad endings.” — discussing speculative bubbles at Berkshire’s shareholder meeting in 2018.

10. “You’re going to be a lot better off owning productive assets over the next 50 years than you will be owning pieces of paper or bitcoin.” — CNBC, March 2014

11. “I get in enough trouble with things I think I know something about. Why in the world should I take a long or short position in something I don’t know anything about? We don’t have to know what cocoa beans are gonna do, or cryptocurrencies, we just have to focus on eight or 10 stocks.”— CNBC, January 2018

12. “It draws in a lot of charlatans who are trying to create various sorts of exchanges or whatever it may be. It’s something where people who are of less than stellar character see an opportunity to clip people who are trying to get rich because their neighbor’s getting rich buying this stuff that neither one of them understands. It will come to a bad ending.” — 2018 shareholder meeting

13. “Bitcoin has been used to move around a fair amount of money illegally. The logical move from the introduction of bitcoin is to go short suitcases because the money that was taken in suitcases from one country to another — suitcases will probably fall off in demand. You can look at that as the economic contribution of bitcoin to the society.” — CNBC, February 2020

14. “We don’t own any, we’re not short any. We’ll never have a position in them.” — CNBC, January 2018

15. “I don’t have any bitcoin. I don’t own any cryptocurrency, I never will. I may start a Warren currency, maybe I can create one and say there’s only going to be 21 million of them. You can have it after I die but you can’t do anything with it except sell it to somebody else.” — CNBC, February 2020

16. “I’m really sorry it happens because people get their hopes up that something like that is gonna change their lives.” — CNBC, February 2019

Read the original article on Business Insider

Top Stories24 hours ago

Top Stories24 hours agoBreaking: Abuja Stampede: 10 people including children feared de3d as they scramble for palliative…

Top Stories23 hours ago

Top Stories23 hours agoBreaking: Okija Stampede: Many Feared De3d @ Nestoil Obi Jackson’s Yuletide Event

News6 hours ago

News6 hours agoNigerian Emergency Agency NEMA Puts All Offices On Alert Over Fatal Stampedes

Sports6 hours ago

Sports6 hours agoOleksandr Usyk defeats Tyson Fury to tetain heavyweight title

Sports6 hours ago

Sports6 hours agoCAF Made Me Believe I Won – Achraf Hakimi

Politics6 hours ago

Politics6 hours agoWe Will Bury PDP, Ibori’s Daughter Blows Hot

Top Stories6 hours ago

Top Stories6 hours agoEmefiele: EFCC secures final forfeiture of 1.925 hectares of landed property linked to former CBN Governor