Top Stories

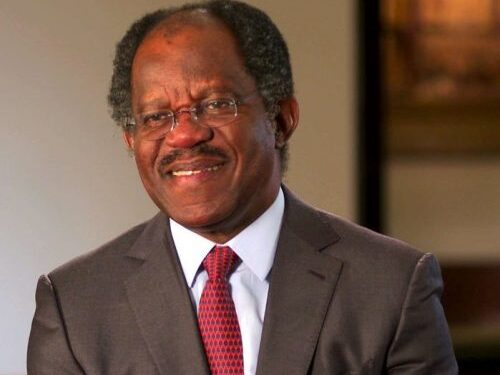

Adebayo Ogunlesi’s net worth to hit $2.3 billion as Blackrock deals mints valuation

Adebayo Ogunlesi, the Chairman and CEO of Global Infrastructure Partners, has seen a significant boost in his net worth to $2.3 billion following the recent acquisition of his firm by American institutional investment company BlackRock Inc. for $12.5 billion.

Reports indicate that this deal is poised to elevate Ogunlesi to billionaire status. With a 17.5% stake in Global Infrastructure Partners, the Bloomberg Billionaires Index estimates his total fortune at approximately $2.3 billion.

By the time the deal is finalized, Ogunlesi will join the likes of Aliko Dangote, Abdul Samad Rabiu, and other Nigerian dollar-denominated billionaires.

The finalized deal, expected in Q3 2024, involves a payment of $3 billion in cash and approximately 12 million shares valued at around $9.5 billion based on January 11 closing prices.

BlackRock Inc. is the world’s largest asset manager, with about $10 trillion Assets Under Management (AUM) as of FY 2023, up by 16% from the $8.59 trillion as of FY 2022. The company recorded a revenue of $4.6 billion in 2023.

At 70 years old, Adebayo Ogunlesi’s illustrious career includes achievements such as an undergraduate degree with first-class honors from Oxford University, a law degree and MBA from Harvard, and a clerkship on the Supreme Court under Thurgood Marshall.

Additionally, he held positions as the head of Credit Suisse’s investment banking division and lead independent director at Goldman Sachs Group Inc.

What you should know

The scion of a medical professor, Adebayo Ogunlesi, embarked on an illustrious career after a brief stint at prestigious law firm Cravath, Swaine & Moore, joining First Boston in his thirties.

- Timing his move perfectly with Wall Street’s ’80s mergers boom, he continued his ascent when Credit Suisse took over, overseeing the investment banking division in 2002.

- Seeking change due to job dissatisfaction, he, along with colleague Matt Harris, conceived the idea of managing infrastructure investments, leading to the founding of Global Infrastructure Partners (GIP) in 2006.

- The GIP portfolio, spanning airports, gas pipelines, wind farms, and more, reflects their success. Ogunlesi’s diverse connections include fireside chats with billionaire Henry Kravis and active roles in White House meetings.

- Currently chairing Joe Biden’s National Infrastructure Advisory Council, he plans to resign as lead independent director at Goldman Sachs post-GIP’s sale. Known for his golfing prowess and philanthropy, Ogunlesi’s journey is a testament to resilience and strategic vision.

Politics15 hours ago

Politics15 hours ago15th Hijrah: Muslim Clerics Task Nigerians On Good Morals

Entertainment16 hours ago

Entertainment16 hours agoI have never said I love you to anyone before – Falz

Sports16 hours ago

Sports16 hours ago‘Don’t wait for England and choose Nigeria when you’re 29’ – Mikel Obi

Top Stories16 hours ago

Top Stories16 hours agoObamas endorse Kamala Harris for president

Top Stories2 hours ago

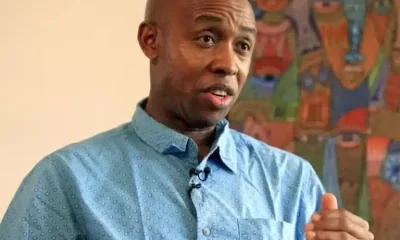

Top Stories2 hours agoPoliticians Buy SUVs For Judges Because Only Their Votes Count – Odinkalu

News3 hours ago

News3 hours agoProtest: You Don’t Know Where This Will End – VP Shettima Tells Nigerians

Entertainment3 hours ago

Entertainment3 hours agoPolice Nabs Newly Married Man For Impregnating Sister-In-Law In Anambra

News2 hours ago

News2 hours agoWorld War III could happen if Kamala Harris wins presidential election – Trump tells Israeli PM Netanyahu during visit