News

Nigeria’s pension industry gains N3.36 trillion in 2023, fastest growth on record

Nigeria’s total pension asset gained a remarkable N3.36 trillion in 2023, closing the year at a record high of N18.36 trillion from N14.99 trillion recorded as of the previous year. This represents a year-on-year increase of 22.43%, which is the fastest growth on record.

This is according to the unaudited report on pension fund portfolio as released by the National Pension Commission (PenCom). Also, the total number of RSA registrations hit 10.19 million as of the end of December 2023, reflecting a 3.3% increase from 9.86 million recorded as of the end of 2022.

Portfolio allocation

A breakdown of the portfolio, showed that investments in federal government securities (N11.92 trillion) accounted for 64.9% of the total assets, which is line with PenCom regulation to invest most of the contributions in fixed less risky assets like the FGN bonds, treasury bills etc.

- Additionally, corporate debt securities (N1.91 trillion) accounted for 10.2% of the assets, while investments in the Nigerian equities market (N1.57 trillion) contributed 8.6% to the total.

- A total of N1.67 trillion was invested in money market instrument as of the end of the year, accounting for 9.1% of the total pension assets.

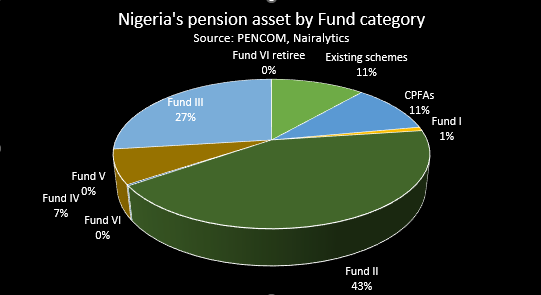

- In terms of breakdown by fund category, Fund II continue to dominate with a total asset value of N7.8 trillion, accounting for 42.5% of the funds. This is the default fund for contributors below the age of 49 years as it allows PFAs 55% of the portfolio in variable instruments.

- Fund III followed with a total portfolio of N4.94 trillion, while Fund V recorded the least amount of N731.4 million.

Pension industry growth

The Nigerian pension industry has recorded significant strides in recent years, as represented in its growing penetration rate. In the last five years, the industry asset value has more than doubled, following several reforms that shaped and is still shaping the industry.

- One of such policies include the increment of the minimum regulatory capital requirement for PFAs from N1 billion to N5 billion, triggering a series of mergers and acquisitions in the industry.

- A move which was aimed at fortifying the financial capacity of the pension administrators. Recall that before the recapitalization in 2021, there were 22 PFAs, however following the implementation, the number of players reduced to about 19, with more anticipated mergers in 2024.

- Also, the restructuring of some major commercial banks into Holding companies, with diversified interest in the pensions industry spurred improved competition in the industry.

- New players such as Access Pensions, Norrenberger Pensions, GT Pensions, Tangerine amongst others have helped to drive increased growth in the industry through market efficiency and profitability.

Access Holdings recently announced that its subsidiary, Access Golf Nigeria has received the necessary regulatory approval to acquire a majority stake in ARM Pension Managers, a move that could further reduce the number of PFAs.

What should know

According to a recent Nairametrics article, a total of 101,820 Retirement Savings Account (RSA) holders switched their Pension Fund Administrators (PFA) in 2023, representing an increase of 10.2% compared to the 92,413 transfers recorded in the previous year, and the highest on record.

A total of N462 billion was moved by the RSA holders in the review year, 28% higher than the N361.5 billion that was transferred in the previous year, bringing the total since the inception of the transfer window to N1.14 trillion.

This transfer is in line with section 13 of the Pension Reform Act (PRA) 2024, which specifies that an RSA holder may transfer his/her account from one PFA to another.

News13 hours ago

News13 hours agoNIGERIAN BREWERIES PARTNERS OZA CARNIVAL

Top Stories50 minutes ago

Top Stories50 minutes ago2025 Budget Cannot Address Nigeria’s Economic Challenges – Atiku

Top Stories24 minutes ago

Top Stories24 minutes agoTinubu’s Aide Condemns Plan To Reinstall ‘Jesus Is Not God’ Banner In Lekki Mosque

News35 minutes ago

News35 minutes agoPresident Tinubu’s reforms not responsible for food stampedes – FG

News46 minutes ago

News46 minutes agoPetrol To Sell ₦935/Litre From Today – IPMAN

Entertainment37 minutes ago

Entertainment37 minutes agoI will be more influential in Nigeria than UK – Tobi Adegboyega