Top Stories

Breaking: LIRS Extends Deadline For Filing Of Annual Tax Returns

The Lagos State Internal Revenue Service (LIRS) has extended the filing of employers’ annual tax returns by one week starting from February 1 to February 7, 2024.

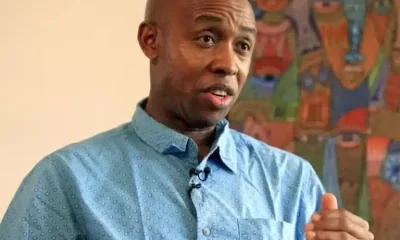

Mr. Ayodele Subair, the Executive Chairman of LIRS, conveyed this in a public notice released by the agency on Tuesday.

The LIRS said statutorily, the filing of annual tax returns by companies expired on January 31st of each fiscal year and attracts stiff penalties for defaulters, urging taxpayers to take advantage of this extension to perform their civic obligation.

The agency stated that the extension is aimed at providing taxpayers with additional time to ensure accurate and timely submission of their annual tax returns.

Subair urged employers of labour to take full advantage of the extension to perform their civic obligation to avoid penalties and other statutory sanctions outlined in section 81(3) of the Personal Income Tax (Amendment) Act 2011.

“We understand that unforeseen circumstances may arise, and this extension is intended to accommodate such instances.

“We implore all employers of labour within Lagos State, who are experiencing difficulties in the filing of their annual tax returns to call our customer service centre on 0700 CALL LIRS (0700 2255 5477) or visit the help desks at our various tax stations.

“It is important to adhere to the revised deadline to maintain compliance and avoid any potential penalties.

“For further details or inquiries, we encourage taxpayers to visit the agency’s website at www.lirs.gov.ng, follow LIRS on social media platforms, or contact us via email at etaxinfo@lirs.net,” the LIRS boss stated.

Politics14 hours ago

Politics14 hours ago15th Hijrah: Muslim Clerics Task Nigerians On Good Morals

Entertainment15 hours ago

Entertainment15 hours agoI have never said I love you to anyone before – Falz

Sports15 hours ago

Sports15 hours ago‘Don’t wait for England and choose Nigeria when you’re 29’ – Mikel Obi

Top Stories15 hours ago

Top Stories15 hours agoObamas endorse Kamala Harris for president

Top Stories1 hour ago

Top Stories1 hour agoPoliticians Buy SUVs For Judges Because Only Their Votes Count – Odinkalu

News2 hours ago

News2 hours agoProtest: You Don’t Know Where This Will End – VP Shettima Tells Nigerians

Entertainment1 hour ago

Entertainment1 hour agoPolice Nabs Newly Married Man For Impregnating Sister-In-Law In Anambra

News35 mins ago

News35 mins agoWorld War III could happen if Kamala Harris wins presidential election – Trump tells Israeli PM Netanyahu during visit