Top Stories

CBN Imposes Limit On Banks’ Foreign Currency Exposure

The Central Bank of Nigeria (CBN) on Wednesday said the Net Open Position (NOP) limit of banks’ overall foreign currency assets and liabilities both on and off-balance sheet should not exceed 20 percent short or 0 percent long of shareholders’ funds unimpaired by losses using the gross aggregate method.

This was disclosed in a circular to all banks, titled ‘Harmonisation of Reporting Requirements on Foreign Currency Exposures of Banks’ jointly signed by Hassan Mahmud, director trade and exchange department of the CBN and Rita Ijeoma Sike, for director, banking supervision department.

The circular mandates that banks must adhere to a NOP limit, ensuring it does not surpass 20 percent short (holding more foreign currency assets than liabilities) or 0% long (not holding more foreign currency assets than the bank’s shareholder funds unimpaired by losses).

It said banks currently exceeding these prescribed NOP limits are obligated to make adjustments to their positions to align with the new regulations by February 1, 2024.

This move is aimed at mitigating risks associated with excessive foreign currency exposure and fostering a more resilient banking sector.

NOP refers to the difference between a bank’s foreign currency assets and liabilities. This includes both on-balance sheet and off-balance sheet items.

Regulatory bodies often impose NOP limits on banks to prevent excessive exposure to foreign currency fluctuations and potential financial instability.

These measures aim to enhance risk management within the banking sector, fostering stability and safeguarding against potential vulnerabilities associated with excessive foreign currency exposure.

In addition to the NOP limits, banks are required to diligently calculate their daily and monthly NOP, along with their Foreign Currency Trading Position (FCT), using specific templates provided by the Central Bank. This meticulous approach aims to enhance transparency in reporting and ensure that banks adhere to the regulatory framework.

These measures underscore the Central Bank’s commitment to fortifying the financial system against potential vulnerabilities, promoting responsible risk management practices within the banking sector.

Banks are urged to promptly adhere to these directives to maintain regulatory compliance and uphold the integrity of the financial system.

According to the circular, banks are also required to have adequate stock of high-quality liquid foreign assets, i.e. cash and government securities in each significant currency to cover their maturing foreign currency obligations. In addition, banks should have in place a foreign exchange contingency funding arrangement with other financial institutions.

The CBN emphasized the importance of strategic financial practices for banks to mitigate foreign currency risks effectively. The key recommendations include borrowing and lending in the same currency, known as natural hedging, to avoid potential mismatches associated with foreign currency exposure.

The circular underscored that the interest rate basis for borrowing should align with that of lending, stressing the importance of eliminating discrepancies in floating and fixed interest rates. This approach aims to mitigate basis risk linked to foreign borrowing interest rate fluctuations, fostering stability in financial operations.

The circular highlighted specific guidelines regarding Eurobonds. It stated that any clause related to early redemption should be initiated by the issuer, and approval must be sought from the CBN. This holds true even if the bond does not qualify as tier 2 capital. The CBN emphasizes the need for timely reporting in this regard.

Politics14 hours ago

Politics14 hours ago15th Hijrah: Muslim Clerics Task Nigerians On Good Morals

Entertainment15 hours ago

Entertainment15 hours agoI have never said I love you to anyone before – Falz

Sports15 hours ago

Sports15 hours ago‘Don’t wait for England and choose Nigeria when you’re 29’ – Mikel Obi

Top Stories15 hours ago

Top Stories15 hours agoObamas endorse Kamala Harris for president

Top Stories2 hours ago

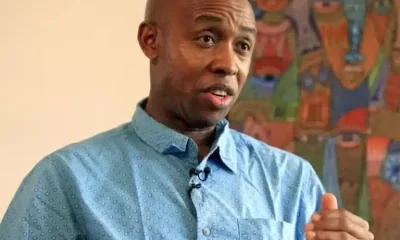

Top Stories2 hours agoPoliticians Buy SUVs For Judges Because Only Their Votes Count – Odinkalu

News2 hours ago

News2 hours agoProtest: You Don’t Know Where This Will End – VP Shettima Tells Nigerians

Entertainment2 hours ago

Entertainment2 hours agoPolice Nabs Newly Married Man For Impregnating Sister-In-Law In Anambra

News45 mins ago

News45 mins agoWorld War III could happen if Kamala Harris wins presidential election – Trump tells Israeli PM Netanyahu during visit