Business and Brands

BUA Foods defies FX woes to record N120.8 billion unaudited pre-tax profit in 2023 FY

In a marketplace where others falter, BUA Foods stands firm, showcasing resilience and strength, overcoming foreign exchange challenges to achieve impressive results.

During the first nine months of 2023, BUA Foods excelled with a pre-tax profit of N111 billion, an impressive achievement considering the substantial pre-tax losses reported by other companies in the sector, primarily attributable to foreign exchange challenges.

Companies such as Nestle, Dangote Sugar, Nigerian Breweries, International Breweries, Cadbury, etc., recorded significant pre-tax losses during this period.

As the final 2023 fiscal year results are awaited, it is anticipated that this trend will persist and be reflected in the financial performance of these companies for the entire fiscal year of 2023.

In line with its trend, BUA Foods, as indicated in its recently released unaudited financial statements, reported a 12.6% YoY growth in profit before tax reaching N120.8 billion compared to the N107.23 billion recorded a year ago, despite facing a N73.56 billion foreign exchange loss.

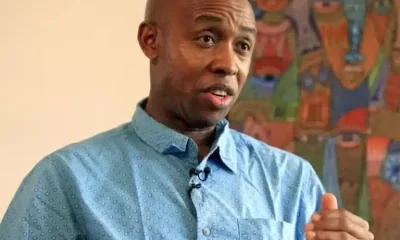

Commenting on the results, Engr. (Dr.) Ayodele Abioye, the Managing Director, said:

“This is a solid performance in the face of an unending challenging macro environment. BUA foods delivered strong growth despite the persistent devaluation of the naira during the period, which led to a substantial and negative impact of foreign exchange losses. Despite the margin squeeze on operating profit to 82%, our business remained resilient to deliver bottom-line growth of 22% to N111.5Bn”

The Managing Director’s comments echo the sentiment that BUA Foods’ consistent and substantial revenue growth underscores its resilience in the face of these challenges.

Revenue growth has been consistent. In 2023, it achieved a significant year-on-year revenue growth of 74.1%, contributing to an impressive four-year compound annual growth rate (CAGR) of 39.41%.

The sustained revenue growth has been instrumental in upholding a robust gross profit margin for the company. In 2023, it achieved a record four-year gross profit margin of 34.5%, which the company attributes to slight adjustments in selling prices and volume increase due to capacity expansion for IRS.

This suggests that the company is adeptly handling its production costs by leveraging its comparative advantage in locally sourced raw materials, facilitated by its vertical integration strategies.

It is anticipated that the revenue growth will persist in the future, largely attributable to market demand, production expansion and the company’s expansion efforts in increasing its market share for sugar and flour products, both of which serve as major revenue drivers. Sugar and bakery flour combined contribute to over 85% of the company’s total revenue.

Furthermore, the reduction in general expenses, salaries, and wages observed in 2023 reflects the company’s dedicated effort to optimize its cost structure and enhance profitability.

This commitment to cost optimization contributed to a remarkable 82% year-on-year growth in operating profit. The reduction in expenses played a significant role in driving the company’s four-year compound annual growth rate (CAGR) to 42%.

This growth serves as a positive indicator of the company’s operational prowess and its ability to create value and return for its shareholders.

Since its listing on the NGX on January 5th, 2022, the share price of the company has exhibited a consistent upward trajectory.

In 2022, it experienced a notable gain of about 63%. The momentum continued into 2023, with an impressive year-to-date (YtD) share price gain of 198%, surpassing the NGX All Share Index (NGXASI) YtD gain of 45.90% at the end of 2023.

In the current year, the share price has further increased by 40.5%, positioning the company as the fifth most valuable stock on the NGX.

The continued market anticipation of substantial growth from the company is evident in its high earnings multiples, which stand at 43x. This indicates that investors are willing to pay a premium for the company’s shares due to their expectations of strong future earnings and performance.

The company’s performance on the NGX and its market valuation indeed suggest a promising outlook and substantial investor interest.

However, BUA Foods needs to proactively identify and implement measures to hedge against currency fluctuations posed by the Naira devaluation.

The company’s 2023 financial statements reveal a significant foreign exchange loss of about N74 billion, marking a departure from its previous performance of avoiding such losses.

However, it is good to note that the company appears to have a relatively healthy balance sheet as reflected in its debt level, financial leverage ratios and retained earnings growth.

While the debt levels have increased, the relatively low debt-to-asset and debt-to-equity ratios suggest that the company has reasonable debt levels compared to its assets and equity.

Additionally, the 13% growth in retained earnings indicates the company’s ability to generate profits, maintain financial stability and sustain its dividend payment policy.

In 2022, it paid out a final dividend of N4.5 per share representing about 89% payout ratio and with a 22% year-on-year growth in profit after tax in 2023, the company is in a strong position to consider increasing dividends while still having room for investment in expansion and growth initiatives.

Politics15 hours ago

Politics15 hours ago15th Hijrah: Muslim Clerics Task Nigerians On Good Morals

Entertainment16 hours ago

Entertainment16 hours agoI have never said I love you to anyone before – Falz

Sports16 hours ago

Sports16 hours ago‘Don’t wait for England and choose Nigeria when you’re 29’ – Mikel Obi

Top Stories16 hours ago

Top Stories16 hours agoObamas endorse Kamala Harris for president

Top Stories2 hours ago

Top Stories2 hours agoPoliticians Buy SUVs For Judges Because Only Their Votes Count – Odinkalu

News3 hours ago

News3 hours agoProtest: You Don’t Know Where This Will End – VP Shettima Tells Nigerians

Entertainment3 hours ago

Entertainment3 hours agoPolice Nabs Newly Married Man For Impregnating Sister-In-Law In Anambra

News2 hours ago

News2 hours agoWorld War III could happen if Kamala Harris wins presidential election – Trump tells Israeli PM Netanyahu during visit